| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

To privately owned international banks that create the money out of thin air.

To privately owned international banks that create the money out of thin air.

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Sovereign debt to government income. Notice how they are all in debt!

greshams-law.com greshams-law.com

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

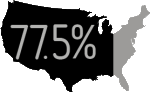

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

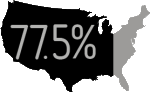

of American households are in debt.

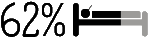

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

Many many years ago before the times of international bankers, no international debt was possible.

Firstly there was no-one to be in debt to.

Secondly direct trade was the only means possible. A sort of barter. Mirrors for pomegranates.

If people got excited about gold, or silver then exchange for gold or silver was possible. But it eventually had to balance as one country would finish up with all the gold. But why would people get excited about gold. If we were not aware of its special status we would likely use it as fishing weights.

When international bankers got involved then debts could build up. How then could they police these debts and enforce them. Mmmm! A small army perhaps. I just thought of a cheaper way. Use someone else’s army. Perhaps your host county could be persuaded to get into a bit of biffo. You would have to convince the people that it was necessary. Mmmm. Buy a newspaper or two. That should control 'Public Opinion'. Politicians? Ambitious and in need of campaign money and promotion. There is another use for your newspapers. Who is going to buy a paper that is full of propaganda. Easy, put a lot of truth on the other pages.

Now logically, if two nations are trading, One will be up million say and the other down a million. The debts average to zero.

Again logically, if many nations trade, their debts will average to zero.

If the nations themselves set up an international trading bank belonging to the nations, again their balances would average to zero.

Well we could continue to trade with gold or silver but not bother to move the gold. We would just keep a tally of who owed how much gold to whoever. I'll help you with that. Just deposit all your gold with me and I'll shift it around between vaults.

I'm honest. I promise that I'm honest and would not falsify the figures, even though I am not going to let you check the figures not let you see your gold ever. Actually, I'll be real good. I'll make loans to you if you are short at a nice low interest rate of 8%. Trust me.

But if I set up an international trading bank, I could play some tricks. I could set up accounts for each. I could claim that I can lend money to countries. I would pretend I was lending money that was deposited by other countries, but as it is all virtual money, I could lend money that does not exist. I would get away with it as the money was only a virtual item anyway. By charging interest, I could make good money. Perhaps double my money each eight years. But the money is virtual anyway, so I could purchase real assets of nations with my virtual money. I could finish up owning the bulk of the worlds shares and assets. I could insist that they increase taxation so the government had more money so I could loan them more. Use nice names of course like 'bailout' and 'Austerity Measures'. With my newspapers I could convince the people that it was the fault of the government. Now that is clever, because the people would blame themselves for voting in a bad government. Then I could lend them some more money and call it a bailout of 'emergency loan' and they would thank me for giving them more of the virtual money. As I create more mythical money, I could cloak it up as and increase in the 'Money Supply'. This would have all those silly economists talking about the rate of increase of the Money Supply without anyone screaming about what I was up-to. Anyway, if they start to starve, I am doing them a favour as my papers have convinced the world that it is overpopulated. Meaning we need to cull anyway. I am doing them a favour by cutting world population.

| |  | |  |

|  |

| |  | | |

CHECK THESE NUMBERS

If it were administered for the benefit of the nations, the average should be zero. Some a billion down, Some a billion up.

| CIA World Factbook. Country Comparison :: Debt - external This entry gives the total public and private debt owed to non-residents repayable in internationally accepted currencies, goods, or services. These figures are calculated on an exchange rate basis, i.e., not in purchasing power parity (PPP) terms. |

| 1 |

United States |

$15,930,000,000,000 |

| 2 |

European Union |

$15,500,000,000,000 |

| 3 |

United Kingdom |

$10,090,000,000,000 |

| 4 |

Germany |

$5,719,000,000,000 |

| 5 |

France |

$5,165,000,000,000 |

| 6 |

Japan |

$3,024,000,000,000 |

| 7 |

Luxembourg |

$2,643,000,000,000 |

| 8 |

Italy |

$2,493,000,000,000 |

| 9 |

Netherlands |

$2,487,000,000,000 |

| 10 |

Spain |

$2,311,000,000,000 |

| 11 |

Ireland |

$2,163,000,000,000 |

| 12 |

Switzerland |

$1,563,000,000,000 |

| 13 |

Belgium |

$1,424,000,000,000 |

| 14 |

Australia |

$1,403,000,000,000 |

| 15 |

Canada |

$1,326,000,000,000 |

| 16 |

Singapore |

$1,174,000,000,000 |

| 17 |

Hong Kong |

$1,047,000,000,000 |

| 18 |

Sweden |

$1,034,000,000,000 |

| 19 |

Austria |

$808,100,000,000 |

| 20 |

China |

$770,800,000,000 |

| 21 |

Norway |

$659,100,000,000 |

| 22 |

Russia |

$631,800,000,000 |

| 23 |

Finland |

$599,300,000,000 |

| 24 |

Denmark |

$587,600,000,000 |

| 25 |

Greece |

$576,600,000,000 |

| 26 |

Portugal |

$508,300,000,000 |

| 27 |

Brazil |

$440,600,000,000 |

| 28 |

Korea, South |

$413,400,000,000 |

| 29 |

India |

$376,300,000,000 |

| 30 |

Poland |

$364,200,000,000 |

| 31 |

Mexico |

$352,900,000,000 |

| 32 |

Turkey |

$336,900,000,000 |

| 33 |

Indonesia |

$251,200,000,000 |

| 34 |

Hungary |

$202,000,000,000 |

| 35 |

United Arab Emirates |

$158,900,000,000 |

| 36 |

Argentina |

$141,100,000,000 |

| 37 |

South Africa |

$137,500,000,000 |

| 38 |

Kazakhstan |

$137,100,000,000 |

| 39 |

Qatar |

$137,000,000,000 |

| 40 |

Ukraine |

$135,000,000,000 |

| 41 |

Thailand |

$133,700,000,000 |

| 42 |

Romania |

$132,100,000,000 |

| 43 |

Saudi Arabia |

$127,400,000,000 |

| 44 |

Taiwan |

$127,400,000,000 |

| 45 |

Chile |

$117,800,000,000 |

| 46 |

Cyprus |

$106,500,000,000 |

| 47 |

Czech Republic |

$101,900,000,000 |

| 48 |

Iceland |

$100,200,000,000 |

| 49 |

Malaysia |

$98,650,000,000 |

| 50 |

Israel |

$93,560,000,000 |

| 51 |

New Zealand |

$90,230,000,000 |

| 52 |

Colombia |

$78,640,000,000 |

| 53 |

Slovakia |

$68,440,000,000 |

| 54 |

Venezuela |

$63,740,000,000 |

| 55 |

Philippines |

$60,340,000,000 |

| 56 |

Croatia |

$59,750,000,000 |

| 57 |

Puerto Rico |

$56,820,000,000 |

| 58 |

Pakistan |

$55,980,000,000 |

| 59 |

Slovenia |

$53,880,000,000 |

| 60 |

Peru |

$52,590,000,000 |

| 61 |

Bulgaria |

$50,540,000,000 |

| 62 |

Iraq |

$50,260,000,000 |

| 63 |

Malta |

$45,770,000,000 |

| 64 |

Vietnam |

$41,850,000,000 |

| 65 |

Latvia |

$39,810,000,000 |

| 66 |

Sudan |

$39,700,000,000 |

| 67 |

Egypt |

$38,820,000,000 |

| 68 |

Bangladesh |

$36,210,000,000 |

| 69 |

Belarus |

$34,120,000,000 |

| 70 |

Morocco |

$33,980,000,000 |

| 71 |

Serbia |

$33,410,000,000 |

| 72 |

Lithuania |

$32,840,000,000 |

| 73 |

Lebanon |

$32,640,000,000 |

| 74 |

Kuwait |

$28,210,000,000 |

| 75 |

Tunisia |

$25,400,000,000 |

| 76 |

Bahrain |

$25,270,000,000 |

| 77 |

Sri Lanka |

$22,820,000,000 |

| 78 |

Cuba |

$22,160,000,000 |

| 79 |

Estonia |

$21,980,000,000 |

| 80 |

Uruguay |

$21,070,000,000 |

| 81 |

Angola |

$19,650,000,000 |

| 82 |

Jordan |

$19,340,000,000 |

| 83 |

Bahamas, The |

$16,680,000,000 |

| 84 |

Dominican Republic |

$16,580,000,000 |

| 85 |

Guatemala |

$16,170,000,000 |

| 86 |

Ecuador |

$15,480,000,000 |

| 87 |

Jamaica |

$14,600,000,000 |

| 88 |

Costa Rica |

$14,470,000,000 |

| 89 |

Panama |

$14,200,000,000 |

| 90 |

Georgia |

$13,360,000,000 |

| 91 |

El Salvador |

$12,840,000,000 |

| 92 |

Korea, North |

$12,500,000,000 |

| 93 |

Ghana |

$11,230,000,000 |

| 94 |

Tanzania |

$11,180,000,000 |

| 95 |

Uzbekistan |

$10,460,000,000 |

| 96 |

Nigeria |

$10,100,000,000 |

| 97 |

Ethiopia |

$9,956,000,000 |

| 98 |

Oman |

$9,768,000,000 |

| 99 |

Kenya |

$9,526,000,000 |

| 100 |

Iran |

$9,452,000,000 |

| 101 |

Bosnia and Herzegovina |

$9,051,000,000 |

| 102 |

Syria |

$8,818,000,000 |

| 103 |

Congo, Democratic Republic of the |

$7,644,000,000 |

| 104 |

Armenia |

$7,629,000,000 |

| 105 |

Zimbabwe |

$6,975,000,000 |

| 106 |

Macedonia |

$6,807,000,000 |

| 107 |

Yemen |

$6,726,000,000 |

| 108 |

Moldova |

$6,132,000,000 |

| 109 |

Mauritius |

$5,768,000,000 |

| 110 |

Laos |

$5,599,000,000 |

| 111 |

Burma |

$5,448,000,000 |

| 112 |

Zambia |

$5,445,000,000 |

| 113 |

Albania |

$5,281,000,000 |

| 114 |

Nicaragua |

$5,228,000,000 |

| 115 |

Libya |

$5,054,000,000 |

| 116 |

Honduras |

$4,884,000,000 |

| 117 |

Mozambique |

$4,880,000,000 |

| 118 |

Papua New Guinea |

$4,860,000,000 |

| 119 |

Trinidad and Tobago |

$4,780,000,000 |

| 120 |

Cote d'Ivoire |

$4,742,000,000 |

| 121 |

Barbados |

$4,490,000,000 |

| 122 |

Algeria |

$4,344,000,000 |

| 123 |

Congo, Republic of the |

$4,225,000,000 |

| 124 |

Namibia |

$4,204,000,000 |

| 125 |

Bolivia |

$4,200,000,000 |

| 126 |

Uganda |

$4,126,000,000 |

| 127 |

Senegal |

$4,117,000,000 |

| 128 |

Azerbaijan |

$4,042,000,000 |

| 129 |

Cambodia |

$3,992,000,000 |

| 130 |

Nepal |

$3,774,000,000 |

| 131 |

Kyrgyzstan |

$3,666,000,000 |

| 132 |

Cameroon |

$3,343,000,000 |

| 133 |

Somalia |

$2,942,000,000 |

| 134 |

Mauritania |

$2,942,000,000 |

| 135 |

Gabon |

$2,758,000,000 |

| 136 |

Mali |

$2,725,000,000 |

| 137 |

Guinea |

$2,652,000,000 |

| 138 |

Madagascar |

$2,631,000,000 |

| 139 |

Mongolia |

$2,564,000,000 |

| 140 |

Burkina Faso |

$2,442,000,000 |

| 141 |

Paraguay |

$2,245,000,000 |

| 142 |

Tajikistan |

$2,200,000,000 |

| 143 |

Botswana |

$1,968,000,000 |

| 144 |

Chad |

$1,749,000,000 |

| 145 |

Montenegro |

$1,700,000,000 |

| 146 |

Belize |

$1,457,000,000 |

| 147 |

Seychelles |

$1,453,000,000 |

| 148 |

Niger |

$1,451,000,000 |

| 149 |

Bermuda |

$1,400,000,000 |

| 150 |

Afghanistan |

$1,280,000,000 |

| 151 |

Bhutan |

$1,275,000,000 |

| 152 |

Guyana |

$1,234,000,000 |

| 153 |

Equatorial Guinea |

$1,232,000,000 |

| 154 |

Malawi |

$1,214,000,000 |

| 155 |

Haiti |

$1,125,000,000 |

| 156 |

Guinea-Bissau |

$1,095,000,000 |

| 157 |

West Bank |

$1,040,000,000 |

| 158 |

Eritrea |

$1,026,000,000 |

| 159 |

Benin |

$953,500,000 |

| 160 |

Rwanda |

$937,200,000 |

| 161 |

Maldives |

$890,800,000 |

| 162 |

Faroe Islands |

$888,800,000 |

| 163 |

Sierra Leone |

$827,600,000 |

| 164 |

Djibouti |

$802,900,000 |

| 165 |

Cape Verde |

$741,300,000 |

| 166 |

Swaziland |

$737,300,000 |

| 167 |

Lesotho |

$715,400,000 |

| 168 |

Gambia, The |

$545,800,000 |

| 169 |

Grenada |

$538,000,000 |

| 170 |

Aruba |

$533,400,000 |

| 171 |

Suriname |

$504,300,000 |

| 172 |

Saint Lucia |

$471,400,000 |

| 173 |

Central African Republic |

$469,500,000 |

| 174 |

Antigua and Barbuda |

$441,200,000 |

| 175 |

Turkmenistan |

$429,100,000 |

| 176 |

Liberia |

$400,300,000 |

| 177 |

Kosovo |

$326,000,000 |

| 178 |

Sao Tome and Principe |

$316,600,000 |

| 179 |

Vanuatu |

$307,700,000 |

| 180 |

Comoros |

$279,300,000 |

| 181 |

Fiji |

$268,000,000 |

| 182 |

Dominica |

$253,800,000 |

| 183 |

Saint Vincent and the Grenadines |

$252,200,000 |

| 184 |

Samoa |

$235,500,000 |

| 185 |

Burundi |

$231,700,000 |

| 186 |

Saint Kitts and Nevis |

$189,100,000 |

| 187 |

Solomon Islands |

$166,000,000 |

| 188 |

Cook Islands |

$141,000,000 |

| 189 |

Tonga |

$118,600,000 |

| 190 |

Marshall Islands |

$87,000,000 |

| 191 |

New Caledonia |

$79,000,000 |

| 192 |

Micronesia, Federated States of |

$60,800,000 |

| 193 |

Greenland |

$36,400,000 |

| 194 |

British Virgin Islands |

$36,100,000 |

| 195 |

Nauru |

$33,300,000 |

| 196 |

Kiribati |

$10,000,000 |

| 197 |

Montserrat |

$8,900,000 |

| 198 |

Anguilla |

$8,800,000 |

| 199 |

Wallis and Futuna |

$3,670,000 |

| 200 |

Niue |

$418,000 |

| 201 |

Brunei |

$0 |

| 202 |

Palau |

$0 |

| 203 |

Macau |

$0 |

| 204 |

Liechtenstein |

$0 |

|

How can we have a situation where all countries of the world are massively in debt to an international bank. A bank that was supposed to help us. How can all these countries be strugling to pay back somthing that never existed in the first place. In the competition to pay back this virtual money they are exporting like crazy and wrecking their environment.

| |  | |  |

|  |

| |  | | |

GO GREEN

The greenest thing we could do for this planet is to forgive all unpayable debt. Then sort out the money system. Each government treasury to issue its own currency debt-free and join a trading block of countries that circumvents the international banks and IMF.

| |  | |  |

|  |

| |  | | |

INTERNATIONAL LOANS ARE NOT NECESSARY

The worst thing you can give a child is debt.

The worst thing you can give a country is debt.

I class money as internal and external. Economists mix these up. If a government owes money internally, is is comparitevely easy to pay off. Although it is entirely unnexessary. If the tax department and the treasury issueing the currency that the tax must be paid with are as one, no debt can exist.

External money requires exports of goods or services.

As external debts increase, some problems arrise:

- Exports must increase.

- Forex will hammer the currency exchange rate. This occurs because 80% of Foreign Exchange Market trading is by speculators not genuine traders in currency for import export purposes. We need to ban currency speculation.

| |  | |  |

|  |

| |  | | |

QUOTES

| |  | |

John Perkins 2011

(IMF) It's a servant of the corporatocracy, of economic hit men. One of my jobs as an economic hit man was to identify countries that had resources like oil and arrange huge loans for those countries from the World Bank and sister organizations. But the money would never go to the actual country; instead it would go to our own corporations to build infrastructure projects in that country like power plants and industrial parks; things that would benefit a few very wealthy families.

So then the people of the country would be left holding this huge debt that they couldn't repay. We would come back and say, "well, since you can't repay your debt, you have to restructure your loan." That's when the IMF comes in. So the World Bank makes the original loan and IMF shows up and says, "We'll help you restructure your loan, but in order to do that you have to meet certain conditionalities. You have to sell your oil or whatever the coveted resource is at a cheap price, to the oil companies without restrictions." Or they would suggest the country sell electric utilities, water and sewage, maybe even your schools and jails to private multi-national corporations. Or maybe allow military bases to be built; these sorts of things.

[As Chief Economist at a major international consulting firm, John Perkins advised the World Bank, United Nations, IMF, U.S. Treasury Department, Fortune 500 corporations, and countries in Africa, Asia, Latin America, and the Middle East. He worked directly with heads of state and CEOs of major companies. His books on economics and geo-politics have sold more than 1 million copies, spent many months on the New York Times and other bestseller lists, and are published in over 30 languages. John's Confessions of an Economic Hit Man (70 weeks on the New York Times bestseller list) is a startling exposé of international corruption.]

| |  | |  |

| |  | |

John Perkins 2011

The World Bank is a tool of economic hit men, there is no question about it. It's the tool of big corporations, the IMF and most of what we call intelligence agencies of the United States, CIA and NSA. Essentially the job of all these organizations is to help what used to be just US businesses — now we call them multi-nationals — get themselves established around the world in positions where they can exploit the world's resources, natural resources and human resources. All of these organizations are basically tools of what they call the corporatocracy. The men and a few women who run the biggest and most powerful corporations also run most of the government. Economic hit men help channel the resources of organizations like the World Bank and the IMF, the NSA and the CIA to support the larger agenda.

http://www.whale.to/c/john_perkins1.html

| |  | |  |

| |  | |

J.W. Smith

Instead of developing the Third World, it is clear that the Third World dependency is a policy of the major powers, and the world leaders insist on restricting consumer buying power in the Third World as a price for what is essentially maintenance loans. Meanwhile, these same leaders easily agreed that West Germany must put $1 trillion into the former East Germany to simultaneously build industry, social infrastructure, and markets. And when the relatively poorer countries of Greece, Portugal, and Spain wanted to join the Common Market, these leaders “implemented a 15-year plan which included massive transfers of direct aid, designed to accelerate development, raise wages, regularize safety and environmental standards, and improve living conditions in poorer nations.”... Emerging former colonies receive no such care for their economies to become viable.

[J.W. Smith, The World’s Wasted Wealth 2, (Institute for Economic Democracy, 1994), P150]

| |  | |  |

| |  | |

UNICEF

According to UNICEF, over 500,000 children under the age of five died each year in Africa and Latin America in the late 1980s as a direct result of the debt crisis and its management under the International Monetary Fund’s structural adjustment programs. These programs required the abolition of price supports on essential food-stuffs, steep reductions in spending on health, education, and other social services, and increases in taxes. The debt crisis has never been resolved for much of sub-Saharan Africa. Extrapolating from the UNICEF data, as many as 5,000,000 children and vulnerable adults may have lost their lives in this blighted continent as a result of the debt crunch.

[Ross P. Buckley, The Rich Borrow and the Poor Repay: The Fatal Flaw in International Finance, World Policy Journal, Volume XIX, No 4, Winter 2002/03]

| |  | |  |

| |  | |  |

|  |

| |  | | |

Linked Articles

How Does the World Bank Function? How Does the World Bank Function?

Exposing undue corporate influence over policy-making at the World Trade Organisation Exposing undue corporate influence over policy-making at the World Trade Organisation

| |  | |  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

"A handful of us determine what will be on the evening news broadcasts, or, for that matter, in the New York Times or Washington Post or Wall Street Journal�. Indeed it is a handful of us with this awesome power�.And those [news stories] available to us already have been culled and re-culled by persons far outside our control."

Walter Cronkite

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About