| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

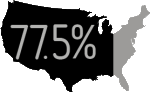

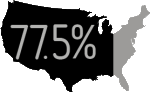

of American households are in debt.

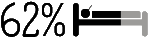

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

Why we need State and Federal Public Banks?

Banks owned by the people and operated by the government for the benefit of the people. It is more than the usual ’Public verses Private’ argument. There is a massive problem when the issue of money is separate from the collection of money as tax. An imbalance occurs called ’National Debt’ or ’State Debt’. The method of issue of the money can accidentally set up a system where the debts exceed the money available to pay those debts. And if you don’t look carefully, you can find your self in a situation where all levels of society can finish up in debt. We have reached this in Australia. But our ’look on the bright side’ approach to life is preventing us from seeing it. If we fix this in Australia, we can be a beacon of light to the rest of the world. they might just follow us for a change.

- Public Banks operate for the benefit of the people not for private profit.

- Public Banks will loan to ordinary citizens currently not able to purchase houses. This means that your children will be able to buy a house instead of renting from someone that owns more than one house.

- Public Banks are not prone to the boom and bust cycle of private banks. When depositors panic, banks scramble to recall loans and lending becomes scarce. A recession is created.

- With Public Banks there is no national or state debt. State and National-Debt arrived when private banks arrived. State and National-Debt cannot exist when States and Nations are funded by Public Banks. International debt arrived when International Banks arrived.

- Public Banks tend to even the spread of wealth. Private banks tend to concentrate wealth.

- Public Banks invest money in local area businesses creating jobs and infrastructure and stronger communities. Private banks tend to concentrate on making money from money and encourage Ponzi style investment and bubbles and placement of money in offshore tax havens.

- Cash should be issued by the Treasury. This will remove the burden of paying for the cash at full face value using taxpayers money. It will also remove the burden of the mounting compound interest payable on the bonds (iou’s) used to pay for the cash.

- Fewer bankruptcies and foreclosures. Foreclosures can claim no more than the asset in question.

- Private banks use Fractional Reserve banking which creates debts that cannot be repaid. The result is that debts keep mounting and debts become bigger than the available money to repay them.

- Public state and federal banks create money as credit by spending into society. The government collects tax and spends it back into society. If it needs extra work done it creates new money. But this is not inflationary as it is spent into society without creating debt. No money is owed. The money is earnt into society and provided it is taxed back out at a sensible rate, all is well. If people are earning more, then more tax will be collected. So it tends to be fairly self balancing. Unlike private banks where money is created when loans are issued. The magnitude of the debt and interest at each stage of production, means that something like 30% of all purchases are interest payments to banks. This is equivalent to three time the GST rate. And the GST itself is effectively used to cover government interest repayment.***

- Public banks have previously been used to develop cities, regions, states or nations. They are usually instrumental in developing a region. A public bank will invest in the areas that need developing. This is done by extending credit to develop infrastructure and business important to the region. This would include: farmers, families, small and medium business, infrastructure.

- Public banks would not form cartels.

- Private banks have to be government backed in the event of a crisis. Thus we have public money guaranteeing private profit. The banks have a protected situation and get government support to prevent failure whilst they act as risk-taking entrepreneurial firms, paying exorbitant executive salaries and biasing their operations to the interests of their shareholders. Thus the risk is public but the profit is private and thus encourages excessive risk taking. In 2008 the large banks were publicly guaranteed. This has given them a massive competitive advantage over the smaller institutions and has enabled them to gain a much larger market share. With this reduced competition, the large banks have been gouging their customers and increasing their profits.

- All loans have to be shown and kept on the banks balance sheets. This is to stop all on-selling of loans and financial assets.

- The creation of money is the responsibility of government. Paper money and coin should come from the Treasury. Money that is lent (virtual money) should come from the federal government or state bank. Private and other banks, credit societies then on-lend the money. Banks should serve as underwriters and performers of credit analysis.

- The logic is that if the government has the right to collect our taxes and spend those taxes, it needs a medium to do that. This is called currency or money. It is thus necessary that they issue the money that is used to pay the taxes that they require us to pay. If the money is created by any other organisation then all sorts of drama and skimming can occur. Other money can be issued by other entities but cannot be used to pay taxes. He who taxes creates the means to pay the taxes. The government needs to spend into society at about the same rate as it taxes.

- The public bank may operate as a high street bank, but it does not need to. It can operate as a bank for banks. Community banks, cooperative banks and credit societies can then flourish.

Australia

In 1945, the Commonwealth Savings Bank and the state savings banks held almost half of total deposits.

Arguments Against Public Banks

- A government bank is susceptible to politically-motivated lending policies and cronyism.

Solution. All lending must be posted on a website. There mustbe an independent review of operations.

- This is communism.

Answer. We accept public ownership of the police, schools, hospitals, roads, airports, ports, government departments. We dont call this communism. The creation of money is so profitable and inter-twined with the viability of the state and the livelihood of the people that it should not be left to private profiteers who have more interest in their personal income and their share holders than the public good.

- Anything the media and big money can throw against it including financing politicians.

- The profit from making money is so huge that within a few years, corporations will get round the legislation and usurp the ability to create money.

Bill Mitchell writes:

| |  | |

An Australian government tried to nationalise the banking system in 1948 but the legislation was challenged by the Bank of New South Wales. The challenge — Bank of New South Wales v The Commonwealth (1948) 76 CLR 1 — which was also known as the Bank Nationalisation Case was decided upon by the High Court in Australia. The court ruled that the Government’s plans were unconstitutional.

The High Court ruled that the nationalisation of private banking would violate an individual right to engage in particular types of trading and commercial activity. Under section 92 of the Constitution, there is deemed to be constitutional freedom of interstate trade and commerce. The Court ruled that the banks had a right to engage in interstate banking which would be lost if there was nationalisation.

Interestingly, this interpretation of section 92 of the Constitution has now been overturned in the Cole v Whitfield case in 1988. So the old grounds for opposing bank nationalisation are now no longer available.

The High Court also ruled that there was a failure in the proposed legislation to provide “just terms” for compensation to the private owners. This was deemed to be in violation of section 51(xxxi) of the Constitution which says that government would provide adequate compensation for compulsory property acquisitions. So this finding did not find that nationalisation violating any principle — it was just a case that the specific legislation was not generous enough.

[Bill Mitchell on Billy Blog]

The full version is here:

| |  | |  |

| |  | |  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

"Banks do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers' transaction accounts."

[Chicago Federal Reserve, Modern Money Mechanics: A Workbook on Bank Reserves and Deposit Expansion]

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About