| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

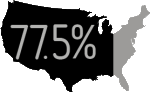

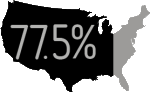

of American households are in debt.

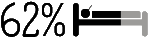

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

Steve Keen’s Debtwatch Manifesto

Trimmed back a bit for mere mortals.

Full pdf version at Steve Keen’s DebtWatch

| |  | |

The fundamental cause of the economic and financial crisis that began in late 2007 was lending by the finance sector that primarily financed speculation rather than investment. The explosion in speculative debt drove asset prices to all-time highs relative to consumer prices from which they are now inexorably collapsing.

The debt and asset price bubbles were ignored by conventional "Neoclassical" economists on the basis of a set of a priori beliefs about the nature of a market economy that are spurious, but deeply entrenched. Understanding how this crisis came about will require a new, dynamic, monetary approach to economic theory that contradicts the neat, plausible and false Neoclassical model that currently dominates academic economics and popular political debate.

Escaping from the debt trap we are now in will require either a "Lost Generation", or policies that run counter to conventional economic thought and the short-term interests of the financial sector.

Preventing a future crisis will require a redefinition of financial claims upon the real economy which eliminates the appeal of leveraged speculation.

These three observations lead to the three primary objectives of Debtwatch:

- To develop a realistic, empirically based, dynamic monetary approach to economic theory and policy;

- To develop and promote a "modern Jubilee" by which private debt can be reduced while doing the minimum possible harm to aggregate demand and social equity; and

- To develop and promote new definitions of shares and property ownership that will minimize the destructive instabilities of capitalism and promote its creative instabilities.

The economic and financial crisis has been caused by unenlightened self-interest and fraudulent behaviour on an unprecedented scale. But this behaviour could not have grown so large were it not for the cover given to this behaviour by the dominant theory of economics, which is known as "Neoclassical Economics".

Though many commentators call this theory "Keynesian", one of Keynes’s objectives in the 1930s was to overthrow this theory, but instead, as the memory of the Great Depression receded, academic economists gradually constructed an even more extreme version of Neoclassical economics than that against which Keynes had fought.

As it grew more virulent, neoclassical theory encouraged politicians to remove the barriers to fraud that were erected in the wake of the last great economic crisis, the Great Depression, in the naïve belief that a deregulated economy necessarily reaches a harmonious equilibrium. Regulators in its thrall such as Greenspan and Bernanke rescued the financial sector from a series of crises, with each one leading to yet another until ultimately this one, from which no return to "business as usual" is possible. Neoclassical economics therefore played an important role in making this crisis as extreme as it became. It is time to succeed where Keynes failed, by both eliminating this theory and replacing it with a realistic alternative.

Critiquing Neoclassical Economics

Keynes was scathing about what he called "Classical Economics", and what we today call Neoclassical Economics, lambasting its treatment of time, expectations, uncertainty and money, and the stability or otherwise of capitalism. Keynes’s failure to overthrow Neoclassical economics led instead to its reconstruction after the Great Depression in an even more extreme form.

Debt acceleration is the main factor in determining asset prices. Asset bubbles therefore have to burst, because debt acceleration cannot remain positive forever.

A Modern Jubilee

Michael Hudson’s simple phrase that “Debts that can’t be repaid, won’t be repaid” sums up the economic dilemma of our times. This does not involve sanctioning “moral hazard”, since the real moral hazard was in the behaviour of the finance sector in creating this debt in the first place. Most of this debt should never have been created, since all it did was fund disguised Ponzi Schemes that inflated asset values without adding to society’s productivity. Here the irresponsibility and Moral Hazard clearly lay with the lenders rather than the borrowers.

The only real question we face is not whether we should or should not repay this debt, but how are we going to go about not repaying it?

The standard means of reducing debt personal and corporate bankruptcies for some, slow repayment of debt in depressed economic conditions for others could have us mired in deleveraging for one and a half decades.

That fate would in turn mean one and a half decades where the boost to demand that rising debt should provide when it finances investment rather than speculation will not be there. The economy will tend to grow more slowly than is needed to absorb new entrants into the workforce, innovation will slow down, and justified political unrest will rise with potentially unjustified social consequences. We don’t need to speculate about the economic and social damage such a future history will cause all we have to do is remember the last time.

We should, therefore, find a means to reduce the private debt burden now, and reduce the length of time we spend in this damaging process of deleveraging. Pre-capitalist societies instituted the practice of the Jubilee to escape from similar traps  , and debt defaults have been a regular experience in the history of capitalism too.

, and debt defaults have been a regular experience in the history of capitalism too.  So a prima facie alternative to 15 years of deleveraging would be an old-fashioned debt Jubilee. So a prima facie alternative to 15 years of deleveraging would be an old-fashioned debt Jubilee.

But a Jubilee in our modern capitalist system faces two dilemmas.

- Firstly, in any capitalist system, a debt Jubilee would paralyse the financial sector by destroying bank assets.

- Secondly, in our era of securitized finance, the ownership of debt permeates society in the form of asset based securities (ABS) that generate income streams on which a multitude of non-bank recipients depend, from individuals to councils to pension funds.

Debt abolition would inevitably also destroy both the assets and the income streams of owners of ABSs, most of whom are innocent bystanders to the delusion and fraud that gave us the Subprime Crisis, and the myriad fiascos that Wall Street has perpetrated in the two decades since the 1987 Stock Market Crash.

We therefore need a way to short-circuit the process of debt-deleveraging, while not destroying the assets of both the banking sector and the members of the non-banking public who purchased ABSs. One feasible means to do this is a “Modern Jubilee”, which could also be described as “Quantitative Easing for the public”.

Quantitative Easing was undertaken in the false belief that this would “kick start” the economy by spurring bank lending.

Instead, its main effect was to dramatically increase the idle reserves of the banking sector while the broad money supply stagnated or fell, for the obvious reasons that there is already too much private sector debt, and neither lenders nor the public want to take on more debt.

A Modern Jubilee would create fiat money in the same way as with Quantitative Easing, but would direct that money to the bank accounts of the public with the requirement that the first use of this money would be to reduce debt. Debtors whose debt exceeded their injection would have their debt reduced but not eliminated, while at the other extreme, recipients with no debt would receive a cash injection into their deposit accounts.

The broad effects of a Modern Jubilee would be:

- Debtors would have their debt level reduced;

- Non-debtors would receive a cash injection;

- The value of bank assets would remain constant, but the distribution would alter with debt-instruments declining in value and cash assets rising;

- Bank income would fall, since debt is an income-earning asset for a bank while cash reserves are not;

- The income flows to asset-backed securities would fall, since a substantial proportion of the debt backing such securities would be paid off;

- Members of the public (both individuals and corporations) who owned asset-backed-securities would have increased cash holdings out of which they could spend in lieu of the income stream from ABS’s on which they were previously dependent.

Clearly there are numerous complex issues to be considered in such a policy:

- the scale of money creation needed to have a significant positive impact (without excessive negative effects there will obviously be such effects, but their importance should be judged against the alternative of continued deleveraging);

- the mechanics of the money creation process itself (which could replicate those of Quantitative Easing, but may also require changes to the legal prohibition of Reserve Banks from buying government bonds directly from the Treasury);

- the basis on which the funds would be distributed to the public; managing bank liquidity problems (since though banks would not be made insolvent by such a policy, they would suffer significant drops in their income streams);

- ensuring that the program did not simply start another asset bubble.

Taming the Finance Sector

Finance performs genuine, essential services in a capitalist economy when it limits itself to

- (a) providing working capital to non-financial corporations;

- (b) funding investment and entrepreneurial activity, whether directly or indirectly;

- (c) funding housing purchase for strictly residential purposes, whether to owner-occupiers for purchase or to investors for the provision of rental properties;

- (d) providing finance to households for large expenditures such as automobiles, home renovations, etc.

It is a destructive force in capitalism when it promotes leveraged speculation on asset or commodity prices, and funds activities (like levered buyouts) that drive debt levels up and rely upon rising asset prices for their success. Such activities are the overwhelming focus of the non-bank financial sector today, and are the primary reason why financial sector debt has risen from trivial levels of below 10 percent of GDP before the 1970s to the peak of over 120 percent in early 2009.

Returning capitalism to a financially robust state must involve a dramatic fall in the level of private debt and the size of the financial sector as well as policies that return the financial sector to a service role to the real economy. The size of the financial sector is directly related to the level of private debt, which in America peaked at 303% of GDP in early 2009. Using history as our guide, America will only return to being a financially robust society when this ratio falls back to below 100% of GDP. Most other OECD countries likewise need to drastically reduce their levels of private debt.

The percentage of total wages and profits earned by the FIRE sector  gives another guide. America’s period of robust economic growth coincided with FIRE sector profits being between 10 and 20 percent of total profits, and wages in the FIRE sector being below 5 percent of total wages. Finance sector profits peaked at over 50% of total profits in 2001, while wages in the FIRE sector peaked at over 9 percent of total wages.

Since finance sector profits are primarily a function of the level of private debt, this implies that the level of debt needs to shrink by a factor of 3—4, while employment in the finance sector needs to roughly halve. At the maximum, the finance sector should be no more than 50% of its current size.

Such a large contraction in the size of the sector means that the majority of those who currently work there will need to find gainful employment elsewhere. Individuals who can actually evaluate investment proposals generally speaking, engineers rather than financial engineers will need to be hired in their place. Many of the standard practices of that sector today will have to be eliminated or drastically curtailed, while many practices that have been largely abandoned will have to be reinstated. gives another guide. America’s period of robust economic growth coincided with FIRE sector profits being between 10 and 20 percent of total profits, and wages in the FIRE sector being below 5 percent of total wages. Finance sector profits peaked at over 50% of total profits in 2001, while wages in the FIRE sector peaked at over 9 percent of total wages.

Since finance sector profits are primarily a function of the level of private debt, this implies that the level of debt needs to shrink by a factor of 3—4, while employment in the finance sector needs to roughly halve. At the maximum, the finance sector should be no more than 50% of its current size.

Such a large contraction in the size of the sector means that the majority of those who currently work there will need to find gainful employment elsewhere. Individuals who can actually evaluate investment proposals generally speaking, engineers rather than financial engineers will need to be hired in their place. Many of the standard practices of that sector today will have to be eliminated or drastically curtailed, while many practices that have been largely abandoned will have to be reinstated.

Taming the Credit Accelerator

Capitalism’s crises have always been a product of the financial sector funding speculation on asset prices rather than funding business and innovation. This allows financial sector profits to grow far larger than is warranted, on the foundation of a far larger level of private debt than society can support. This lending causes a positive feedback loop between accelerating debt and rising asset prices, leading to both a debt and asset price bubble. The asset price bubble must burst because it relies upon accelerating debt for its maintenance but once it bursts, society is still left with the debt.

The underlying cause is the relationship between debt and asset prices in a credit-based economy. ........ It therefore follows that there is a relationship between the acceleration of debt and change in asset prices.

Some acceleration of debt is vital for a growing economy. As good empirical work by Fama and French has confirmed (Fama and French 1999; Fama and French 2002), change in debt is the main source of funds for investment, and as Schumpeter explains (Schumpeter 1934, pp. 95—107), the interplay between investment and the endogenous creation of spending power by the banking system ensures that this will be a cyclical process. Debt acceleration during a boom and deceleration during a slump are thus essential aspects of capitalism.

However this relation also implies that the acceleration of debt is a factor in the rate of change of asset prices (along with the change in income) and that when asset prices grow faster than incomes and consumer prices, the motive force behind it will be the acceleration of debt. At the same time, the growth in asset prices is the major incentive to accelerating debt: this is the positive feedback loop on which all asset bubbles are based, and it is why they must ultimately burst. This is the foundation of Ponzi Finance  , and it is this aspect of finance that has to be tamed to reduce the destructive impact of finance on capitalism. , and it is this aspect of finance that has to be tamed to reduce the destructive impact of finance on capitalism.

I do not believe that regulation alone will achieve this aim, for two reasons.

- Minsky’s proposition that “stability is destabilizing” applies to regulators as well as to markets. If regulations actually succeed in enforcing responsible finance, the relative tranquillity that results from that will lead to the belief that such tranquillity is the norm, and the regulations will ultimately be abolished. After all, this is what happened after the last Great Depression.

- Banks profit by creating debt, and they are always going to want to create more debt. This is simply the nature of banking. Regulations are always going to be attempting to restrain this tendency, and in this struggle between an “immovably object” and an “irresistible force”, I have no doubt that the force will ultimately win.

If we rely on regulation alone to tame the financial sector, then it will be tamed while the memory of the crisis it caused persists, only to be overthrown by a resurgent financial sector some decades hence.

There are thus only two options to limit capitalism’s tendencies to financial crises: to change the nature of either lenders or borrowers in a fundamental way. There are proposals for the former, which I’ll discuss later, but (for reasons I’ll discuss now) my preference is to address the latter by reducing the appeal of leveraged speculation on asset prices.

There are, I believe, no prospects for fundamentally altering the behaviour of the financial sector because, as already noted, the key determinant of profits in the finance sector is the level of debt it can generate. However it is organised and whatever limits are put upon its behaviour, it will want to create more debt.

There are prospects for altering the behaviour of the non-financial sector towards debt because, fundamentally, debt is a bad thing for the borrower: the spending power of debt now is an enticement, but with it comes the drawback of servicing debt in the future. For that reason, when either investment or consumption is the reason for taking on debt, borrowers will be restrained in how much they will accept. Only when they succumb to the enticement of leveraged speculation will borrowers take on a level of debt that can become systemically dangerous.

The difference between the two series is obvious. Regardless of the endless inducements from the finance sector to enter into personal debt, commitments by the public to personal debt are generally related to and regulated by income. Commitments to debt for the purchase of assets, on the other hand, are related not to income, but to expectations of leveraged profits on rising asset prices when the factor most responsible for causing growth in asset prices is accelerating debt.

This relationship between debt acceleration and change in asset prices is especially apparent for mortgage debt. The R2 between mortgage debt acceleration and change in real house prices is 0.78 in the USA over 25 years, and 0.6 in Australia over 30 years. Though debt acceleration can enable increased construction or turnover, the far greater flexibility of prices, and the treatment of housing as a vehicle for speculation rather than accommodation, means that the brunt of the acceleration drives house price appreciation. The same effect applies in the far more volatile share market: accelerating debt leads to rising asset prices, which encourages more debt acceleration.

The link between accelerating debt levels and rising asset prices is therefore the basis of capitalism’s tendency to experience financial crises. That link has to be broken if financial crises are to be made less likely if not avoided entirely. This requires a redefinition of financial assets in such a way that the temptations of Ponzi Finance can be eliminated.

Jubilee Shares

The key factor that allows Ponzi Schemes to work in asset markets is the “Greater Fool” promise that a share bought today for $1 can be sold tomorrow for $10. No interest rate, no regulation, can hold against the charge to insanity that such a feasible promise ferments, and on such a foundation the now almost forgotten folly of the DotCom Bubble was built. Both the promise and the folly are well illustrated in Yahoo’s share price.

I propose the redefinition of shares in such a way that the enticement of limitless price appreciation can be removed, and the primary market can take precedence over the secondary market. A share bought in an IPO or rights offer would last forever (for as long as the company exists) as now with all the rights it currently confers. It could be sold once onto the secondary market with all the same privileges. But on its next sale it would have a life span of 50 years, at which point it would terminate.

The objective of this proposal is to eliminate the appeal of using debt to buy existing shares, while still making it attractive to fund innovative firms or startups via the primary market, and still making purchase of the share of an established company on the secondary market attractive to those seeking an annuity income.

I can envisage ways in which this basic proposal might be refined, while still maintaining the primary objective of making leveraged speculation on the price of existing share unattractive. The termination date could be made a function of how long a share was held; the number of sales on the secondary market before the Jubilee effect applied could be more than one. But the basic idea has to be to make borrowing money to gamble on the prices of existing shares a very unattractive proposition.

“The Pill”

At present, if two individuals with the same savings and income are competing for a property, then the one who can secure a larger loan wins. This reality gives borrowers an incentive to want to have the loan to valuation ratio increased, which underpins the finance sector’s ability to expand debt for property purchases.

Since the acceleration of debt drives the rise in house prices, we get both the bubble and the bust. But since houses turn over much more slowly than do shares, this process can go on for a lot longer. The buildup of mortgage debt therefore also goes on for much longer.

Limits on bank lending for mortgage finance are obviously necessary, but while those controls focus on the income of the borrower, both the lender and the borrower have an incentive to relax those limits over time. This relaxation is in turn the factor that enables a house price bubble to form while driving up the level of mortgage debt per head.

I instead propose basing the maximum debt that can be used to purchase a property on the income (actual or imputed) of the property itself. Lenders would only be able to lend up to a fixed multiple of the income-earning capacity of the property being purchased regardless of the income of the borrower. A useful multiple would be 10, so that if a property rented for $30,000 p.a., the maximum amount of money that could be borrowed to purchase it would be $300,000. Under this regime, if two parties were vying for the same property, the one that raised more money via savings would win. There would therefore be a negative feedback relationship between leverage and house prices: an general increase in house prices would mean a general fall in leverage.

I call this proposal The Pill, for “Property Income Limited Leverage”. This proposal is a lot simpler than Jubilee Shares, and I think less in need of tinkering before it could be finalized. Its real problem is in the implementation phase, since if it were introduced in a country where the property bubble had not fully burst, it could cause a sharp fall in prices. It would therefore need to be phased in slowly over time except in a country like Japan where the house price bubble is well and truly over (even though house prices are still falling).

There are many other proposals for reforming finance, most of which focus on changing the nature of the monetary system itself. The best of these focus on instituting a system that removes the capacity of the banking system to create money via “Full Reserve Banking”.

Full Reserve Banking

The former could be done by removing the capacity of the private banking system to create money. This is the substance of the American Monetary Institute’s proposals, which are now embodied in the National Emergency Employment Defense Act of 2011 (HR 2990)  . This bill would remove the capacity of the banking sector to create money, along the lines the the 100% reserve proposals first championed by Irving Fisher during the Great Depression . This bill would remove the capacity of the banking sector to create money, along the lines the the 100% reserve proposals first championed by Irving Fisher during the Great Depression  , and vest the capacity for money creation in the government alone. , and vest the capacity for money creation in the government alone.

A similar system is proposed by the UK’s New Economic Foundation with its Positive Money proposal.

Technically, both these proposals would work. I won’t go into great detail on them here, other than to note my reservation about them, which is that I don’t see the banking system’s capacity to create money as the causa causans of crises, so much as the uses to which that money is put. As Schumpeter explains so well, the endogenous creation of money by the banking sector gives entrepreneurs spending power that exceeds that coming out of “the circular flow” alone. When the money created is put to Schumpeterian uses, it is an integral part of the inherent dynamic of capitalism. The problem comes when that money is created instead for Ponzi Finance reasons, and inflates asset prices rather than enabling the creation of new assets.

My caution with respect to full reserve banking systems is that this endogenous expansion of spending power would become the responsibility of the State alone. Here, though I am a proponent of government counter-cyclical spending, I am sceptical about the capacity of government agencies to get the creation of money right at all times. This is not to say that the private sector has done a better job far from it! But the private banking system will always be there even if changed in nature ready to exploit any slipups in government behaviour that can be used to justify a return to the system we are currently in. Slipups will surely occur, especially if the new system still enables speculation on asset prices to occur.

Since in the real world, people forget and die, the memory of the chaos we are living through now won’t be part of the mindset when those slipups occur, especially if the end of the Age of Deleveraging ushers in a period of economic tranquillity like the 1950s. We could well have 100% money reforms “reformed” out of existence once more.

Schumpeterian banking also inherently includes the capacity to make mistakes: to fund a venture that doesn’t succeed, and yet to be willing to take that risk again in the hope of funding one that succeeds spectacularly. I am wary of the capacity of that mindset to co-exist with the bureaucratic one that dominates government.

So though I am not opposed to the 100% Reserve Banking proposal, I am not enthusiastic either. I believe they need curbs on the capacity to finance asset price speculation like Jubilee Shares and The Pill, and if they have them, these alone might achieve most of what monetary reformers hope to achieve with far more extensive change to the financial system.

Steve Keen’s Debtwatch http://www.debtdeflation.com/blogs/manifesto

Full pdf version at Steve Keen’s DebtWatch

| |  | |  |

| |  | |  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

Albert Einstein 1930

"For example, most of the major states of history owed their existence to conquest. The conquering peoples established themselves, legally and economically, as the privileged class of the conquered country. They seized for themselves a monopoly of the land ownership and appointed a priesthood from among their own ranks. The priests, in control of education, made the class division of society into a permanent institution and created a system of values by which the people were thenceforth, to a large extent unconsciously, guided in their social behavior."

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About