| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

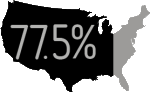

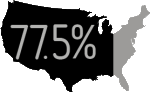

of American households are in debt.

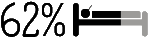

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

Everything is Going Swimmingly

Is your money safe in the banks?

The Financial Claims Scheme (FCS) covers $250,000 per person per institution. This provides $20 billion available to guarantee the deposits in any failed Australian bank.

- In 2012 ANZ had $397 billion deposits.

- Commonwealth Bank had $401 billion.

- NAB had $420 billion deposits.

- Westpac had $395 billion deposits.

$20 billion is not enough to cover any one bank going bankrupt.

$20 billion is not enough to cover any one bank going bankrupt.

$20 billion is not enough to cover any one bank going bankrupt.

$20 billion is not enough to cover any one bank going bankrupt.

$20 billion is not enough to cover any one bank going bankrupt.

| |  | | APRA noted that a pre-funded deposit insurance scheme in Australia would not be insurance in the true sense, as failure by one of the four largest institutions would be likely to exceed the scheme’s resource.

[Reserve Bank of Australia Confidential Council of Financial Regulators Minutes of The Twenty Seventh Meeting, 19 June 2009]

| |  | |  |

| |  | | The limit of AU$20 billion per ADI [Authorised Deposit-taking Institution = Bank] would not be sufficient to cover the protected deposits of any of the four major banks, even though their assets would ultimately be sold to fund any depositor reimbursements if the FCS was used in the resolution process. . In any event, there could be circumstances in which these banks would be deemed too big to undergo payout and liquidation.

[Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Sounds dodgy. To big to sell! Say good bye to your money.

| |  | | .....four large domestic banks dominate the ADI sector, accounting for roughly 75% of total ADI assets [loans]. ...

These banks have grown substantially in size, ranking among the top 60 banks worldwide in terms of consolidated assets. Their focus, however, remains primarily on the domestic and New Zealand markets, which represent over three-quarters of their total assets [loans are assetts to a bank]. ..... Interest income from primarily mortgage and consumer lending accounts for roughly two-thirds of the major banks’ total income .......

[Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Sounds like a burst of a housing bubble would cause a spot of bother. What could cause a housing bubble to burst?

| |  | | Apart from New Zealand, there had been little incentive for Australian banks to invest offshore, in part because the domestic market is more profitable. As discussed below, while the banks’ non-performing loans (NPL) ratio rose during the crisis, it remained lower than in other countries, particularly for housing loans. This may be partly attributed to the prudential and consumer protection frameworks as well as to the fact that all Australian mortgages are ‘full recourse’, i.e. households are liable for the outstanding balance of the loan.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Re-written: They are ripping us off compared to overseas banks. We are dumb enough not to have ’Home-Owners-Protection’ legislation so they can have the pound of flesh from us after they have taken the house.

| |  | | Exposures to the household sector and to commercial real estate (including developers of residential property) represent a large share of Australian ADI assets and a potential source of risk.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Housing Bubble?

| |  | | To assist smaller banks, credit unions and building societies (CUBS) and non-bank institutions’ continued access to funding from the securitisation market, the Government established a purchase program of up to AU$20 billion of residential mortgage-backed securities (RMBS)

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Isn’t that the stuff that caused the 2008 crash?

| |  | | In September 2008, naked short selling of domestic equities was banned and a temporary ban, which has subsequently been lifted, was placed on covered short selling of financial and nonfinancial equities as a ‘circuit breaker’ to assist in maintaining and restoring market confidence.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Short selling should be banned full stop. ’Short Selling’ is selling something before you bought it. It is purely for financial gain at the expense of ordinary people. The vulture class love it and we are dumb enough to let them do it to us.

| |  | | ...This caused the collapse of some financial advisory firms that had margin lending as a core element of their business models, resulting in significant losses for retail investors.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

A margin loan lets you borrow money to invest. It uses your shares as security. The vulture class love it.

| |  | | Australian banks are well placed to meet the Basel III capital standards. Their average Tier 1 capital ratio already exceeds the minimum Basel III requirement, while almost 75% of their capital is in the form of common equity.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Appears to be designed to kill small banks. Basel III capital requirements were approved by G20, of course.

| |  | | The RBA has also issued, on behalf of the Council of Financial Regulators, a discussion paper seeking feedback on whether to establish central clearing of over-the-counter (OTC) derivatives in Australia.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

The derivatives figures in Australia are staggering. We appear to have between $15 to $20 trillion in exposure to derivatives. We have a gross national product of about ~$1.5 trillion. We have more chance of winning the Olympics than surviving a hiccup in the derivatives market. Derivatives are like bets for the rich guys.

| |  | | Australian banks have made good progress in reducing their dependence on wholesale (particularly external) funding.

[21 September 2011. Bank for International Settlement. Financial Stability Board country peer reviews]

| |  | |  |

Overseas funding would be unnecessary if we had our own national and state public banks backed by the resources of the nation. This is what we had with the Commonwealth Bank from 1911 to 1924. It is now our turn to copy China. China has public banks financing its growth at no cost to the nation. An this banking system is probably what is allowing them to own much of our debt and purchase whatever property we will allow them buy.

| |  | | AFMA letter to Australian Treasury, 11 January 2013, page 5

The FSB’s Key Attributes lays out its principles for executing a bail-in within resolution. We welcome the role of the bail-in tool for a resolution. However, APRA, as the resolution authority,should have the power to enact a bail-in for banks incorporated in Australia during a resolution.

[AFMA letter to Australian Treasury, 11 January 2013]

| |  | |  |

What! Cyprus style Bail-in organised for Australia!

The Australian Treasury’s consultation paper further tells us that the Goldman-Sachs chaired, FSB-directed new regime for Cyprus-style bail-in of banks using depositors savings was endorsed by the G20:

| |  | | Financial Stability Board

In October 2011, the FSB issued its Key Attributes of Effective Resolution Regimes for Financial Institutions (Key Attributes). The Key Attributes set out relatively comprehensive principles on the resolution of Systemically Important Financial Institutions (SIFIs) and other financial institutions. The G20 has endorsed the Key Attributes as an international standard on financial crisis resolution and they will be incorporated into the Financial Sector Assessment Program (FSAP) administered by the International Monetary Fund (IMF) and the World Bank.

[Australian Treasury, Strengthening APRA’s Crisis Management Powers, September 2012]

| |  | |  |

Forget about voting — just let the octopus run our country for us.

| |  | | Intuitively you may think that when you deposit your money in a bank, it’s yours, and the bank has to give it back on demand — but that’s not completely true. It’s legally the bank’s money now, says Brown. The bank only has to give it back to the extent that it has money left to give after settling up with parties who have a higher priority than the depositors. .... It turns out that the counterparties in a bank’s derivatives trades actually have higher priority in getting paid back than ordinary depositors. That’s right: The very same folks who are engaging in the speculative trades that are likely to bring down the bank are also the ones who will step to the front of the line to get paid off if the bank does fail. ...... Yves Smith, at the Naked Capitalism blog, underscores Brown’s point about the risk to ordinary depositors due to their position subordinate to derivatives traders. ...... remember, depositors are unsecured creditors .....

[US News. Is Your Money Safe in a ’Too Big to Fail’ Bank? By DAVID BRODWIN.]

| |  | |  |

If you think it can’t happen in Australia, you are deluded.

| |  | | Alternet US Site

Although few depositors realize it, legally the bank owns the depositor’s funds as soon as they are put in the bank. Our money becomes the bank’s, and we become unsecured creditors holding IOUs or promises to pay. (See here and here.)

[Alternet US Website]

| |  | |  |

| |  | |  |

|  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

William Paterson 1694

"The bank hath benefit of interest on all moneys which it creates out of nothing."

[William Paterson, founder of the Bank of England in 1694, then a privately owned bank.]

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About