| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

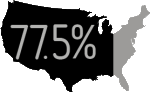

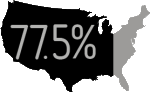

of American households are in debt.

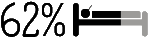

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

Don’t be so stupid! There can’t be more debt than money. That would mean that it is impossible to pay off the debt. True. The debts cannot be repaid. More debt is created to pay off past interest.

| |  | |  |

|  |

| |  | | |

Example One - The Australian Debt Clock

Debt ~$4.7 trillion. Money ~$1.57 trillion.

Total Australian Debt = ~$4.7 trillion = ~$47000 billion = ~ $4700 000 000 000

Broad Money Supply = ~$1.57 trillion = ~$15000 billion = ~ $1500 000 000 000

Please have a look at the Australian Debt Clock to get your head around some numbers.

Conclusion: There is more debt than money.

| |  | |  |

|  |

| |  | | |

About $53 billion in cash notes has been issued by the Reserve Bank of Australia, (RBA)

There are about $1000 billion bank deposits from business and private households.

There are about $2000 billion loans to business and private households.

Notice a big difference.

Observation One: The cash does not match the deposits. If you thought the banks have the cash to pay back the depositors, think again.

$53 billion as cash notes but $1 trillion deposits and $2 trillion in loans.

Conclusion: There are more deposits than cash available to pay back the depositors.

Conclusion: There is more debt than money.

Conclusion: Deposits cannot be repaid in cash legal tender.

| |  | |  |

|  |

| |  | | |

Example Three - National Review Online

Our Debt is More Than All the Money in the World

by Kevin D. Williamson 9 September 2010

| |  | |

"Just a reminder: We are in trouble.

I have argued that the real national debt is about $130 trillion. Let’s say I’m being pessimistic. Forbes, in a 2008 article, came up with a lower number: $70 trillion. Let’s say the sunny optimists at Forbes got it right and I got it wrong. For perspective: At the time that 2008 article was written, the entire supply of money in the world (“broad money,” i.e., global M3, meaning cash, consumer-account deposits, checkable accounts, CDs, long-term deposits, travelers’ checks, money-market funds, the whole enchilada) was estimated to be just under $60 trillion. Which is to say: The optimistic view is that our outstanding obligations amount to more than all of the money in the world. Global GDP in 2008? Also about $60 trillion. Meaning that the optimistic view is that our federal obligations outpace the entire annual economic output of human civilization."

| |  | |  |

Conclusion: There is more debt than money in the world.

| |  | |  |

|  |

| |  | | |

Example Four - All the Banks in the World

Consider all the banks in the world. They are all lending out money at say ten percent to make the maths easy. At the end of the year, the world for borrowers owe all the money back plus ten percent. Can this be paid back? On compound interest this magnifies. Here is $1000 over twenty years. The money doubles every eight years. $1000.00, $1100.00, $1210.00, $1331.00,$1464.10, $1610.51, $1771.56, $1948.72, $2143.59, $2357.95, $2593.74, $2853.12, $3138.43, $3452.27, $3797.50, $4177.25, $4594.97, $5054.47, $5559.92, $6115.91, $6727.50

Conclusion: There is More debt than money.

| |  | |  |

|  |

| |  | | |

Example Five - Australian Reserve Bank RBA

Australian Reserve Bank is supposedly wholly owned by the ’Commonwealth of Australia’. Hopefully that is not the ’Commonwealth of Australia’ as listed on the New York Stock Exchange. href="http://www.sec.gov/cgi-bin/browse-edgar?company=Commonwealth+of+Australia&CIK=&filenum=&State=&SIC=&owner=include&action=getcompany" target="_blank"> Australian cash is created out of thin air. Our sticky plastic notes cost little to produce. To release our sticky notes, the RBA exchanges the notes for interest bearing Commonwealth Government Bonds (also called Commonwealth Government Securities, Treasury Bonds,Treasury Stock) . This releases cash into the society. These bonds are interest bearing. Thus we are all paying interest on RBA issued cash. We cannot get rid of the debt whilst interest is being paid to a central bank and that debt compounds. My guess is that we cannot get rid of the compounding interest unless the issue of the cash noted is taken over by the treasury as it was until 1959. What are Commonwealth Government Bonds? Governments usually borrow by issuing bonds. Bonds pay annual interest. ’The main component of gross debt on the Australian Government’s balance sheet is Commonwealth Government Securities (Treasury Bonds) outstanding.’ Australian cash is created out of thin air. Our sticky plastic notes cost little to produce. To release our sticky notes, the RBA exchanges the notes for interest bearing Commonwealth Government Bonds (also called Commonwealth Government Securities, Treasury Bonds,Treasury Stock) . This releases cash into the society. These bonds are interest bearing. Thus we are all paying interest on RBA issued cash. We cannot get rid of the debt whilst interest is being paid to a central bank and that debt compounds. My guess is that we cannot get rid of the compounding interest unless the issue of the cash noted is taken over by the treasury as it was until 1959. What are Commonwealth Government Bonds? Governments usually borrow by issuing bonds. Bonds pay annual interest. ’The main component of gross debt on the Australian Government’s balance sheet is Commonwealth Government Securities (Treasury Bonds) outstanding.’  Bonds are effectively IOU’s and are backed by the future taxes of the people of Australia. Some countries borrow from supra-national organisations like the World Bank or IMF or from international banks. The first ever government bond was issued by the Bank of England in 1693 to raise money to fund a war against France. Bonds are effectively IOU’s and are backed by the future taxes of the people of Australia. Some countries borrow from supra-national organisations like the World Bank or IMF or from international banks. The first ever government bond was issued by the Bank of England in 1693 to raise money to fund a war against France.  Thus Bonds arrived when central Banks took over from Treasury. The Bank of England was set up by a group of private bankers and took over the issue of money in the UK in 1994. National Debt arrived with private banks. Can we pay this back? Possibly. But why not just let Treasury issue the notes without paying interest to the RBA. The RBA claims it is wholly ’Commonwealth of Australia’ owned and remits back to the Federal Government. My guess is that about $2.5 billion interest is payable annually on the cash notes issued. We don’t get that much back from the RBA. If you were to say that all Australian money starts as cash and gets deposited in bank accounts, which is the logic of the concept of ’The Money Supply’, then the calculation is huge. Thus Bonds arrived when central Banks took over from Treasury. The Bank of England was set up by a group of private bankers and took over the issue of money in the UK in 1994. National Debt arrived with private banks. Can we pay this back? Possibly. But why not just let Treasury issue the notes without paying interest to the RBA. The RBA claims it is wholly ’Commonwealth of Australia’ owned and remits back to the Federal Government. My guess is that about $2.5 billion interest is payable annually on the cash notes issued. We don’t get that much back from the RBA. If you were to say that all Australian money starts as cash and gets deposited in bank accounts, which is the logic of the concept of ’The Money Supply’, then the calculation is huge.

Conclusion: There is More debt than money.

| |  | |  |

|  |

| |  | | |

Example Six - When the principal is created, the interest is not.

The money needed to pay the interest does not exist. Solution. More debt. If you look at a nations debt figures, they usually go up at about the same rate as the interest rate. For the first decade following Federation, the Australian Government did not have any public debt. Neither did we have a Central Bank!

Conclusion: There is More debt than money.

| |  | |  |

|  |

| |  | | |

Example Seven - Australian Money

If the money in Australia is made up of money owed to the RBA and money owed to private banks, how does the nation get the extra money to pay the interest. The only source of money is RBA and more loans from the banks. If the interest rate is five percent, then mathematically five percent more loans must be issued each year for the interest to be paid. If extra money is not generated then like a game of musical chairs, someone loses their chair. The bank takes your assets and sells them in a fire-sale and bills you the outstanding amount and a bit extra. Nice people and perfectly legal. Thus we have the unusual situation that if the banks don’t issue five percent more money each year then five percent will foreclose and we will call it a recession. It is a little more complex than this, but for illustration, you can see a problem with our system.

| |  | |  |

|  |

| |  | | |

Example Eight

| |  | | The Guardian UK

Have we got more debt than money?

Patrick Collinson. The Guardian. 9 April 2008

UK ...

"As individuals, we owe £1200 billion in mortgages. On top of that we have loaded another £220 billion on to our credit cards and personal loans. Are we really so leveraged that we don’t have the money to repay our debts? The £1200 billion in mortgage debt is more than matched by the value of the UK’s housing stock. According to the Halifax, the total value of Britain’s houses at the end of 2007 was £4000 billion. At banks and building societies we have deposits worth £556 billion. In our wallets, there’s around £48 billion in cash. It’s not enough to cover the debt, but good for a few rainy days’ repayments."  | |  | |  |

Conclusion: There is More debt than money.

| |  | |  |

|  |

| |  | | |

Example Nine - The Economist Global Public Debt

Notice that all available nations are in debt. How can it be that all are in debt? This has only happened since 1796 and the start of Central Banking.

| |  | |  |

|  |

| |  | | |

Example Ten - CIA World Factbook

Country Comparison :: Debt - external This entry gives the total public and private debt owed to non-residents repayable in internationally accepted currencies, goods, or services. These figures are calculated on an exchange rate basis, i.e., not in purchasing power parity (PPP) terms.

| 1 |

United States |

$15,930,000,000,000 |

| 2 |

European Union |

$15,500,000,000,000 |

| 3 |

United Kingdom |

$10,090,000,000,000 |

| 4 |

Germany |

$5,719,000,000,000 |

| 5 |

France |

$5,165,000,000,000 |

| 6 |

Japan |

$3,024,000,000,000 |

| 7 |

Luxembourg |

$2,643,000,000,000 |

| 8 |

Italy |

$2,493,000,000,000 |

| 9 |

Netherlands |

$2,487,000,000,000 |

| 10 |

Spain |

$2,311,000,000,000 |

| 11 |

Ireland |

$2,163,000,000,000 |

| 12 |

Switzerland |

$1,563,000,000,000 |

| 13 |

Belgium |

$1,424,000,000,000 |

| 14 |

Australia |

$1,403,000,000,000 |

| 15 |

Canada |

$1,326,000,000,000 |

| 16 |

Singapore |

$1,174,000,000,000 |

| 17 |

Hong Kong |

$1,047,000,000,000 |

| 18 |

Sweden |

$1,034,000,000,000 |

| 19 |

Austria |

$808,100,000,000 |

| 20 |

China |

$770,800,000,000 |

| 21 |

Norway |

$659,100,000,000 |

| 22 |

Russia |

$631,800,000,000 |

| 23 |

Finland |

$599,300,000,000 |

| 24 |

Denmark |

$587,600,000,000 |

| 25 |

Greece |

$576,600,000,000 |

| 26 |

Portugal |

$508,300,000,000 |

| 27 |

Brazil |

$440,600,000,000 |

| 28 |

Korea, South |

$413,400,000,000 |

| 29 |

India |

$376,300,000,000 |

| 30 |

Poland |

$364,200,000,000 |

| 31 |

Mexico |

$352,900,000,000 |

| 32 |

Turkey |

$336,900,000,000 |

| 33 |

Indonesia |

$251,200,000,000 |

| 34 |

Hungary |

$202,000,000,000 |

| 35 |

United Arab Emirates |

$158,900,000,000 |

| 36 |

Argentina |

$141,100,000,000 |

| 37 |

South Africa |

$137,500,000,000 |

| 38 |

Kazakhstan |

$137,100,000,000 |

| 39 |

Qatar |

$137,000,000,000 |

| 40 |

Ukraine |

$135,000,000,000 |

| 41 |

Thailand |

$133,700,000,000 |

| 42 |

Romania |

$132,100,000,000 |

| 43 |

Saudi Arabia |

$127,400,000,000 |

| 44 |

Taiwan |

$127,400,000,000 |

| 45 |

Chile |

$117,800,000,000 |

| 46 |

Cyprus |

$106,500,000,000 |

| 47 |

Czech Republic |

$101,900,000,000 |

| 48 |

Iceland |

$100,200,000,000 |

| 49 |

Malaysia |

$98,650,000,000 |

| 50 |

Israel |

$93,560,000,000 |

| 51 |

New Zealand |

$90,230,000,000 |

| 52 |

Colombia |

$78,640,000,000 |

| 53 |

Slovakia |

$68,440,000,000 |

| 54 |

Venezuela |

$63,740,000,000 |

| 55 |

Philippines |

$60,340,000,000 |

| 56 |

Croatia |

$59,750,000,000 |

| 57 |

Puerto Rico |

$56,820,000,000 |

| 58 |

Pakistan |

$55,980,000,000 |

| 59 |

Slovenia |

$53,880,000,000 |

| 60 |

Peru |

$52,590,000,000 |

| 61 |

Bulgaria |

$50,540,000,000 |

| 62 |

Iraq |

$50,260,000,000 |

| 63 |

Malta |

$45,770,000,000 |

| 64 |

Vietnam |

$41,850,000,000 |

| 65 |

Latvia |

$39,810,000,000 |

| 66 |

Sudan |

$39,700,000,000 |

| 67 |

Egypt |

$38,820,000,000 |

| 68 |

Bangladesh |

$36,210,000,000 |

| 69 |

Belarus |

$34,120,000,000 |

| 70 |

Morocco |

$33,980,000,000 |

| 71 |

Serbia |

$33,410,000,000 |

| 72 |

Lithuania |

$32,840,000,000 |

| 73 |

Lebanon |

$32,640,000,000 |

| 74 |

Kuwait |

$28,210,000,000 |

| 75 |

Tunisia |

$25,400,000,000 |

| 76 |

Bahrain |

$25,270,000,000 |

| 77 |

Sri Lanka |

$22,820,000,000 |

| 78 |

Cuba |

$22,160,000,000 |

| 79 |

Estonia |

$21,980,000,000 |

| 80 |

Uruguay |

$21,070,000,000 |

| 81 |

Angola |

$19,650,000,000 |

| 82 |

Jordan |

$19,340,000,000 |

| 83 |

Bahamas, The |

$16,680,000,000 |

| 84 |

Dominican Republic |

$16,580,000,000 |

| 85 |

Guatemala |

$16,170,000,000 |

| 86 |

Ecuador |

$15,480,000,000 |

| 87 |

Jamaica |

$14,600,000,000 |

| 88 |

Costa Rica |

$14,470,000,000 |

| 89 |

Panama |

$14,200,000,000 |

| 90 |

Georgia |

$13,360,000,000 |

| 91 |

El Salvador |

$12,840,000,000 |

| 92 |

Korea, North |

$12,500,000,000 |

| 93 |

Ghana |

$11,230,000,000 |

| 94 |

Tanzania |

$11,180,000,000 |

| 95 |

Uzbekistan |

$10,460,000,000 |

| 96 |

Nigeria |

$10,100,000,000 |

| 97 |

Ethiopia |

$9,956,000,000 |

| 98 |

Oman |

$9,768,000,000 |

| 99 |

Kenya |

$9,526,000,000 |

| 100 |

Iran |

$9,452,000,000 |

| 101 |

Bosnia and Herzegovina |

$9,051,000,000 |

| 102 |

Syria |

$8,818,000,000 |

| 103 |

Congo, Democratic Republic of the |

$7,644,000,000 |

| 104 |

Armenia |

$7,629,000,000 |

| 105 |

Zimbabwe |

$6,975,000,000 |

| 106 |

Macedonia |

$6,807,000,000 |

| 107 |

Yemen |

$6,726,000,000 |

| 108 |

Moldova |

$6,132,000,000 |

| 109 |

Mauritius |

$5,768,000,000 |

| 110 |

Laos |

$5,599,000,000 |

| 111 |

Burma |

$5,448,000,000 |

| 112 |

Zambia |

$5,445,000,000 |

| 113 |

Albania |

$5,281,000,000 |

| 114 |

Nicaragua |

$5,228,000,000 |

| 115 |

Libya |

$5,054,000,000 |

| 116 |

Honduras |

$4,884,000,000 |

| 117 |

Mozambique |

$4,880,000,000 |

| 118 |

Papua New Guinea |

$4,860,000,000 |

| 119 |

Trinidad and Tobago |

$4,780,000,000 |

| 120 |

Cote d’Ivoire |

$4,742,000,000 |

| 121 |

Barbados |

$4,490,000,000 |

| 122 |

Algeria |

$4,344,000,000 |

| 123 |

Congo, Republic of the |

$4,225,000,000 |

| 124 |

Namibia |

$4,204,000,000 |

| 125 |

Bolivia |

$4,200,000,000 |

| 126 |

Uganda |

$4,126,000,000 |

| 127 |

Senegal |

$4,117,000,000 |

| 128 |

Azerbaijan |

$4,042,000,000 |

| 129 |

Cambodia |

$3,992,000,000 |

| 130 |

Nepal |

$3,774,000,000 |

| 131 |

Kyrgyzstan |

$3,666,000,000 |

| 132 |

Cameroon |

$3,343,000,000 |

| 133 |

Somalia |

$2,942,000,000 |

| 134 |

Mauritania |

$2,942,000,000 |

| 135 |

Gabon |

$2,758,000,000 |

| 136 |

Mali |

$2,725,000,000 |

| 137 |

Guinea |

$2,652,000,000 |

| 138 |

Madagascar |

$2,631,000,000 |

| 139 |

Mongolia |

$2,564,000,000 |

| 140 |

Burkina Faso |

$2,442,000,000 |

| 141 |

Paraguay |

$2,245,000,000 |

| 142 |

Tajikistan |

$2,200,000,000 |

| 143 |

Botswana |

$1,968,000,000 |

| 144 |

Chad |

$1,749,000,000 |

| 145 |

Montenegro |

$1,700,000,000 |

| 146 |

Belize |

$1,457,000,000 |

| 147 |

Seychelles |

$1,453,000,000 |

| 148 |

Niger |

$1,451,000,000 |

| 149 |

Bermuda |

$1,400,000,000 |

| 150 |

Afghanistan |

$1,280,000,000 |

| 151 |

Bhutan |

$1,275,000,000 |

| 152 |

Guyana |

$1,234,000,000 |

| 153 |

Equatorial Guinea |

$1,232,000,000 |

| 154 |

Malawi |

$1,214,000,000 |

| 155 |

Haiti |

$1,125,000,000 |

| 156 |

Guinea-Bissau |

$1,095,000,000 |

| 157 |

West Bank |

$1,040,000,000 |

| 158 |

Eritrea |

$1,026,000,000 |

| 159 |

Benin |

$953,500,000 |

| 160 |

Rwanda |

$937,200,000 |

| 161 |

Maldives |

$890,800,000 |

| 162 |

Faroe Islands |

$888,800,000 |

| 163 |

Sierra Leone |

$827,600,000 |

| 164 |

Djibouti |

$802,900,000 |

| 165 |

Cape Verde |

$741,300,000 |

| 166 |

Swaziland |

$737,300,000 |

| 167 |

Lesotho |

$715,400,000 |

| 168 |

Gambia, The |

$545,800,000 |

| 169 |

Grenada |

$538,000,000 |

| 170 |

Aruba |

$533,400,000 |

| 171 |

Suriname |

$504,300,000 |

| 172 |

Saint Lucia |

$471,400,000 |

| 173 |

Central African Republic |

$469,500,000 |

| 174 |

Antigua and Barbuda |

$441,200,000 |

| 175 |

Turkmenistan |

$429,100,000 |

| 176 |

Liberia |

$400,300,000 |

| 177 |

Kosovo |

$326,000,000 |

| 178 |

Sao Tome and Principe |

$316,600,000 |

| 179 |

Vanuatu |

$307,700,000 |

| 180 |

Comoros |

$279,300,000 |

| 181 |

Fiji |

$268,000,000 |

| 182 |

Dominica |

$253,800,000 |

| 183 |

Saint Vincent and the Grenadines |

$252,200,000 |

| 184 |

Samoa |

$235,500,000 |

| 185 |

Burundi |

$231,700,000 |

| 186 |

Saint Kitts and Nevis |

$189,100,000 |

| 187 |

Solomon Islands |

$166,000,000 |

| 188 |

Cook Islands |

$141,000,000 |

| 189 |

Tonga |

$118,600,000 |

| 190 |

Marshall Islands |

$87,000,000 |

| 191 |

New Caledonia |

$79,000,000 |

| 192 |

Micronesia, Federated States of |

$60,800,000 |

| 193 |

Greenland |

$36,400,000 |

| 194 |

British Virgin Islands |

$36,100,000 |

| 195 |

Nauru |

$33,300,000 |

| 196 |

Kiribati |

$10,000,000 |

| 197 |

Montserrat |

$8,900,000 |

| 198 |

Anguilla |

$8,800,000 |

| 199 |

Wallis and Futuna |

$3,670,000 |

| 200 |

Niue |

$418,000 |

| 201 |

Brunei |

$0 |

| 202 |

Palau |

$0 |

| 203 |

Macau |

$0 |

| 204 |

Liechtenstein |

$0 |

How can we have a situation where all countries of the world are massively in debt to an international bank. A bank that was supposed to help us. How can we have a situation where all countries of the world are massively in debt to an international bank. A bank that was supposed to help us.

| |  | |  |

|  |

| |  | | |

Example Eleven - Monopoly Money Example.

I have ten people in a room representing the people of a nation. I lend each one $100. The interest rate is 10%. So I lend out $1000. At the end of the year I am owed $1100. Give me my money. They cannot pay. Someone goes broke and looses their house.

| |  | |  |

|  |

| |  | | |

Example Twelve - FED

| |  | | verginiahammon

I’m hoping you or someone on the blog can help with a US question. I’ve taken 2 spreadsheets from the FED: Money_Stock M3-(available from 1958-2006, when it was discontinued) and compared the numbers from the FED’s "Total outstanding debt by sector,"(which includes a breakdown into financial and nonfinancial sectors). For the years available for M3, the ratio of debt to M3 ranges from 24.3% to 46.4%, with an average of 36%. What does this mean? How can there be roughly 3 times as much debt as money, if money is created by debt? | |  | |  |

| |  | |  |

|  |

| |  | | |

Example Thirteen - Simon Thorpe

| |  | | Total Global Debt and Money Supply : Twice as much debt as there is money A week or two back, I raised the question of how it was possible that total debt within the Eurozone (i.e public sector debt and private sector debt combined) could be 2.5 times higher than the total Eurozone money supply. Specifically, the debt at the end of 2011 was €23.78 trillion, whereas the money supply measured by M3 was only €9.76 trillion.

Does this 2.5:1 ratio of total debt to money supply apply outside the Eurozone? Well, to find out, I have compiled data for the 39 countries in the BIS Private Sector Debt database and then added in the numbers for Public Sector (which I got from a very nice World Debt Clock website done by the Economist) to get total debt.

I then used the data on money supply provided by a remarkable site called Trading Economics where you can get money supply data by clicking on each country’s link. Money supply numbers are not always standard, but most of the time you can get either M2 or M3. I had to multiply the numbers by the USD exchange rate to get the money supply in dollars. So, here is the result. | |  | |  |

| |  | | I have ranked the 39 countries in terms of the Money Supply. China comes top with a money supply of $15.72 trillion, followed by the Eurozone ($15.2 trillion), the USA ($10.44 trillion), Japan ($10.40 trillion) and the UK ($3.19 trillion). Note that some of the Eurozone countries are effectively in the table twice (Germany, France etc) because the BIS figures include a 40th number for all the Eurozone countries, but the totals and the bottom exclude the Eurozone figures.

Total Private sector debt is $89.27 trillion and Total Public Sector debt is $47.62 trillion, making a total debt level of $139.89 trillion. Adding together the money supplies of all the countries together produces a total of $68.34 trillion. That is exactly half the level of debt. In other words, even if every last cent was added together, we could still only pay off half the debt. In other words, the 2.5:1 ratio of debt to money supply that I noted for the Eurozone is a pretty typical case. The last column gives the ratio of debt to money supply for each country. For some reason, Scandinavian countries like Norway, Sweden and Denmark all have very high ratios of well over 4:1. But the USA is also up there with a debt to money supply ratio of 3.5:1.

There are only five countries that actually have a money supply large enough to cover their debt (coloured in green in the table). Apparently Mexico is one of them, but this seems extremely odd — maybe an error in there somewhere. The other four are China, Hong Kong, Saudia Arabia and Luxembourg. That seems to make sense. But even if you combine all their money supply surpluses, you still only get about $18.5 trillion. So, even they are totally unable to help pay off the mountain of debt that the world has amassed.

I find these figures quite incredible. They demonstrate quite clearly that those who have been lending the money that we owe can’t possibly have had the money they lent. The whole thing is a complete con. What’s the solution? Well, it seems to me that everyone should agree that we actually effectively need to temporarily double the world’s money supply and use that money to pay back this fictitious debt. The only place that this can be done is by using the Central Banks to create new debt free money and using that new money to pay off the debt. Seems like a sensible plan to me.

| |  | |  |

| |  | |  |

|  |

| |  | | |

Example Fourteen - The New Arthurian Economics

US Debt per Dollar

Graph #1: USA Corporate Profits (blue) and Corporate Interest Paid (red)

![The New Arthurian Economics [http://newarthurianeconomics.blogspot.com.au/2013/10/i-wonder-if-there-was-some-cost-that.html]](http://www.moredebtthanmoney.com/images/graphs/fredgraph-Corporate-Profits-blue-and-Corporate-Interest-Paid-red.png)

This graph compares USA corporate interest cost and corporate profits. Both were down near zero from the late 1940s to around 1970, with profits running a little higher than interest cost. Around 1970 the positions changed. Interest cost went higher than profits. Both lines climbed gradually, side by side, until the late 1970s. Then suddenly, interest costs separated from profits and went through the roof. (Thanks to ’The New Arthurian Economics’)

Corporate Interest Paid, per Dollar of Corporate Profits

![Graph: Corporate Interest Paid, per Dollar of Corporate Profits [http://newarthurianeconomics.blogspot.com.au/] and [http://research.stlouisfed.org/fred2/graph/?g=n5T]](http://www.moredebtthanmoney.com/images/graphs/fredgraph-Corporate-Interest-Paid-per-Dollar-of-Corporate-Profits.png)

Dollars of interest cost per dollar of profit.

[Graph: USA Corporate Interest Paid, per Dollar of USA Corporate Profits]

(Thanks to ’The New Arthurian Economics’)

Whatever the amount is, for all intent an purposes, the Fractional Reserve Banking allows practically unlimited capacity for the banks to create money. I almost fell off the chair when I came across it. How is it possible? How it is possible to be debt free when there is more debt than available money? Let me bring you back the core fact about our monetary system - over 95% of our ’money’ are actually created out of thin air and extended as credit to borrowers. That means that almost every dollar in circulation are borrowed from the commercial banks - and incur interests. The amount that we borrowed from the banks constitutes our money supply, and the amount that we have to pay back eventually is our debt. The difference between them is the interest spread. What it means that the society as a whole has to borrow ever larger amount of money to pay back the old debts. The economy can function this way - as long as the banks are willing to continue to extend credit to roll over the old debts. This is like playing musical chair. Everything will appear OK as long as the music keeps playing. But it should be clear the total debt will increase at a compounding rate. This is exponential growth in mathematical terms, but in reality defaults do occur, especially during the periodic bust cycle, so the rate of growth will be dampened somewhat. It should be clear now that our society can never be free of debt. It is a mathematical certainty. Some economists argue that growth in debt is OK as long as the economy is growing at a faster rate. For example it is OK for the debt of a company to grow at the rate of 5% p.a. if the company is expanding at the rate of 7% p.a. This is one key characteristic of our monetary system - it assumes and demands the economy to grow at an exponential rate. This is clearly an impossibility with real world constraints like limits in natural resources, the decreasing and aging population in developed countries. The periodic boom and bust cycle is inevitable with our current monetary system. It is clear that the sovereign debt crisis the world is facing now is impossible to resolve without changing the current monetary system. No amount of austerity measure is enough to bring down the debt. The only way debt can be reduced in our economy is via massive defaults, massive reduction of our money supply, and the resulting massive recession. The way we are trying to solve the problem now is by massive printing of money, in the name of quantitative easing. It is essentially creating more debt and injecting more of the same poison that is killing our economy. Think about it. Every country in the world (Germany inclusive!) are seriously in debt. Please let me know if you find a country that is not in debt. But just to whom are these money owed to? Something very fishy and very sinister is happening here.

| |  | |  |

|  |

| |  | | |

Example Fifteen

Banks always loan out money at interest. So there will always be more debt then there is money."

| |  | |  |

|  |

| |  | | |

Example Sixteen

| |  | | andychalkley

Money is created as debt under the private corporate banking system. For easy maths let’s assume interest at 10%. So $1000 of money is created by $1000 debt. After one year, there is still $1000 of money but there is $1100 debt. After two years, there is still $1000 of money but there is $1210 debt. Ho hum and we didn’t notice. National Debt arrived with Central Banks. If the entity that collects the taxes is different to the entity issuing the money, an imbalance will occur. That imbalance is called National Debt. National Debt cannot exist without private banks. International Debt arrived with international banks. International Debt would not exist if we had direct barter trade between nations. However it is not recommended as you will go the way of Sadam and Hitler and Ghadafi, if you try.

| |  | |  |

| |  | |  |

|  |

| |  | | |

Example Seventeen

Michael Snyder

| |  | |

Why is the global economy in so much trouble? How can so many people be so absolutely certain that the world financial system is going to crash? Well, the truth is that when you take a look at the cold, hard numbers it is not difficult to see why the global financial pyramid scheme is destined to fail. In the United States today, there is approximately 56 trillion dollars of total debt in our financial system, but there is only about 9 trillion dollars in our bank accounts. So you could take every single penny out of the banks, multiply it by six, and you still would not have enough money to pay off all of our debts. Overall, there is about 190 trillion dollars of total debt on the planet. But global GDP is only about 70 trillion dollars. And the total notional value of all derivatives around the globe is somewhere between 600 trillion and 1500 trillion dollars. So we have a gigantic problem on our hands. The global financial system is a very shaky house of cards that has been constructed on a foundation of debt, leverage and incredibly risky derivatives. We are living in the greatest financial bubble in world history, and it isn’t going to take much to topple the entire thing. And when it falls, it is going to be the largest financial disaster in the history of the planet.

[The Economic Collapse Blog. The Global Financial Pyramid Scheme. Michael Snyder. 20 March 2013]

| |  | |  |

| |  | |  |

|  |

| |  | | |

Example Eighteen - Anonymous Coward

Teacher: If I print 10 dollar notes and there are only 10 dollar notes in existence, yet I charge you 1 dollar interest, then where do you get the 11 dollars to pay me back ?

Johnny: I don’t

Teacher" Well then Johnny I will have to take your house as collateral. Thank you for the free home.

| |  | |  |

|  |

| |  | | |

Example Nineteen

There is WAY more debt in the world than there is money to repay it.

Above Top Secret.

| |  | |

That’s the whole point of Usury.

I always try and explain in like this to people that don’t quite ’get it’. (I realize this is an over simplification).

Imagine when the whole usury thing began that there where 10 coins in existence.

Someone comes along and wants to borrow said 10 coins, the lender says ’ok, but you will have to pay a 10% interest rate on the loan’. This is where the problem comes in, the borrower now owes the lender 11 coins, the original 10 coins borrowed plus 10% - 1 coin. However there are only 10 coins in existence, so the debt can NEVER be repaid.

[TerryMcGuire ] http://www.abovetopsecret.com/forum/thread934808/pg1

| |  | |  |

reply to post by ’creative’

| |  | |

Following that reasoning, would it not therefore be a form of fraud to expect someone to pay back something that does not exist?

| |  | |  |

reply to post by ’MystikMushroom’

| |  | |

I’m not sure who’s more of an idiot, the people running the show -- or the masses who let them run the show?

| |  | |  |

reply to post by ’crankyoldman’

| |  | |

The printing of the money is not the issue, this creates inflation. It is the NON-printing of the interest that is owed on the printing of the loan money that is the issue.

| |  | |  |

reply to post by ’FortAnthem ’

| |  | |

Growth in national debt directly corresponds to a growth in the money supply. And most countries use the same type of debt based system now, so it’s a world wide debt crisis.

| |  | |  |

| |  | |  |

|  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

"Banks do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers' transaction accounts."

[Chicago Federal Reserve, Modern Money Mechanics: A Workbook on Bank Reserves and Deposit Expansion]

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About

![The New Arthurian Economics [http://newarthurianeconomics.blogspot.com.au/2013/10/i-wonder-if-there-was-some-cost-that.html]](http://www.moredebtthanmoney.com/images/graphs/fredgraph-Corporate-Profits-blue-and-Corporate-Interest-Paid-red.png)

![Graph: Corporate Interest Paid, per Dollar of Corporate Profits [http://newarthurianeconomics.blogspot.com.au/] and [http://research.stlouisfed.org/fred2/graph/?g=n5T]](http://www.moredebtthanmoney.com/images/graphs/fredgraph-Corporate-Interest-Paid-per-Dollar-of-Corporate-Profits.png)