| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

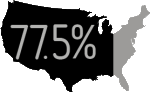

of American households are in debt.

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

HOW MONEY IS CREATED IN AUSTRALIA

The volume of cash folding notes in Australia is $50B.  These notes were created by the Reserve Bank of Australia. The Reserve Bank of Australia claims to be wholly owned by the Commonwealth of Australia. However it claims to be independent of the Government. So there is a question of who controls it and how much control is exerted by international banks. However, we shall leave that for now. Thus the total amount of money issued over the years by the Reserve Bank totals $50B. The Reserve Bank lists the Money Supply as M1 $283B and M3 as $1576B and Broad Money as $1583B. M1 is $50B cash issued by Reserve Bank plus deposits in banks. Thus Money supply deposits in banks equals about $230B. The $230B was not issued by the Reserve Bank on behalf of the Government or who ever controls or owns the Reserve Bank. Who then issued the $230B. Well the $230B is deposits in the banks. It was created when loans were created. A loan of $100 000 will create $100 000 in a deposit account. $100 000 of debt is created as a loan document and $100 000 is created in a bank account, most likely transferred immediately to a third party. The mythical money moves around from account to account using cheques, cards and online transactions and thus acts as money. If loans are paid off then the volume of money in society drops causing problems. The debt magnifies by compound interest. The only way to pay off interest is to use some of the money supply, again reducing the money supply. Thus we are on a debt treadmill. These notes were created by the Reserve Bank of Australia. The Reserve Bank of Australia claims to be wholly owned by the Commonwealth of Australia. However it claims to be independent of the Government. So there is a question of who controls it and how much control is exerted by international banks. However, we shall leave that for now. Thus the total amount of money issued over the years by the Reserve Bank totals $50B. The Reserve Bank lists the Money Supply as M1 $283B and M3 as $1576B and Broad Money as $1583B. M1 is $50B cash issued by Reserve Bank plus deposits in banks. Thus Money supply deposits in banks equals about $230B. The $230B was not issued by the Reserve Bank on behalf of the Government or who ever controls or owns the Reserve Bank. Who then issued the $230B. Well the $230B is deposits in the banks. It was created when loans were created. A loan of $100 000 will create $100 000 in a deposit account. $100 000 of debt is created as a loan document and $100 000 is created in a bank account, most likely transferred immediately to a third party. The mythical money moves around from account to account using cheques, cards and online transactions and thus acts as money. If loans are paid off then the volume of money in society drops causing problems. The debt magnifies by compound interest. The only way to pay off interest is to use some of the money supply, again reducing the money supply. Thus we are on a debt treadmill.

The banks either didn’t realise they were creating 97% of the money supply or kept very quiet about it.

There are significant problems and disadvantages with this arrangement.

- The government and the people go into massive debt so the banks can create money.

- The government looses the seigniorage.

- The people pay tax to cover the interest payments.

- The money supply can only grow as persons, businesses, and governments increase their debts to the banks.

- During a depression, incomes fall, lending then falls and the money supply falls.

- It destroys money just when it is most needed and precipitates a slump

- A mathematical oversight causes the government and the people to get deeper and deeper into debt.

- It has many or the faults that caused usury to be banned for most of recorded history.

- It is a logically flawed system that can only end in collapse, war or enslavement. Debt increases faster than the ability to repay the debt. the exponential nature ensures the debts can never be repaid.

- During steadier times, private debts increase relative to income, so eventually a "robust" financial environment is transformed into a more "fragile" financial environment.

- Government loses the ability to direct money to areas that benefit society such as agriculture and local businesses that employ.

- The local businesses and farmers tend to get loans knocked back causing lack of employment and farm foreclosures and suicides.

- Bankers are in the position to decide which individuals or what industry gets the money they need and who doesn’t.

- Bankers are in the position to decide which political party and which politician gets money and which ones do not.

- Bankers are in the position to decide which media outlets get money and which ones do not.

- Bankers are in the position to decide which countries get money to finance wars.

- It tends to favour housing investors rather than first-time home owners. This is particularly noticeable in Australia where tax advantages favour the investor. The tax advantages price the owner-occupiers out of the market towards those with the greatest tax rate, and thus the lowest effective interest rate.

- Lending is done for profit motives rather than to benefit of society as a whole. This biases money towards bubble type investments.

- Lending tends to move towards money making schemes rather than local business and job creation.

- Lending tends to go towards those with existing assets rather than the battler trying to improve his lot.

- It tends to increase inequality.

- It is basically dishonest as people are led to believe that their deposits represent government issued currency. It does not. The currency simply does not exist. The bank balance is a promise to repay in legal tender that does not exist.

- It tends to inflate asset values including land and shares.

- Government loses the ability to direct money to areas that benefit society such as agriculture and local business.

- Created money has a corresponding debt. Banks can only create money when they create a corresponding debt. If the taxing body (the government) creates the money there is no corresponding debt.

- The government has to pay interest on the bonds used in exchange for the cash that the Reserve Bank issues. The public has to pay tax to pay the face value of the currency to the creator of the currency. The public then has to pay tax to pay the interest on the bonds for evermore every year for all the currency ever issued including the notes that disappeared in washing machines.

- The illogicality of the government creating bonds out of thin air to exchange for currency created out of thin air. Then paying interest on the thin air bonds. And the taxpayers paying tax to pay the interest.

- The government loosing out on the massive profits available to those creating money. And thus the public having to pay taxes to make up for the losses which are the gain of the banks that create money.

- The banks take the real-wealth assets of the borrower in return for cost free credit created out of thin air.

Money can clearly be created at will by the banks. The money supply in Australia has increased over the years.

| Year |

Currency Currency

Notes and Coins |

Money Supply M1 |

Money Supply M3 |

| 1959 |

$0.8B |

|

$6.7B |

| 1976 |

$2.7B |

$10.3B |

$32.6B |

| 2013 |

$56B |

$283B |

$1580B |

| |

Reserve Bank of Australia |

(RBA 3%) + 97% by

|

|

So money is not a static item. New money is clearly constantly being created in big quantities. Only 3% of this new money is created by the supposedly Australian owned Reserve Bank. The remaining 97% is created by the banks of Australia. As all this bank created virtual money has to match an equal amount of debt, we are guaranteed to wallow in debt permanently. Any attempt to pay off our debts will destroy our money supply. Unless of course we start transacting in cash only. and the debt will magnify due to the evil of compound interest.

This constantly created new money tends to be directed to where the bank considers profitable. So investors and speculators including housing investors are more important than businesses and farmers. So we have a nation of pretty houses increasingly owned by price bubble creating speculators and scrappy businesses that cant get loans. We have suicidal farmers being foreclosed by banks that were themselves insolvent until bailed out. The farm properties being sold off to countries that have government owned public banks and governments not fun by bankers. Can you name the bankers that are in parliament? Where will they get high paid work when they leave, assuming they behave in parliament? The items to expect from the banker politicians are

- Increased taxes to pay increased debt.

- Student debt to government or banks. Makes little difference as government debt or student debt both benefit the userers.

- Projects that require bank funding.

Serious consideration needs to be given to:

- Who has authority to create money.

- Who has ownership of newly created money.

- How is is spent into society and by whom.

- Whether newly spent money is used for speculation or spent on national infrastructure like bridges, ports and rail-roads or on local businesses that create jobs and thus increased government revenue.

We need to consider how newly created money is spent into society and by whom.

- Used for speculation in the financial system including offshore systems and tax havens..

- Used for purchasing rental properties.

- Used for owner occupier housing.

- Used for business start-ups. Creating local jobs and follow on expansion of local trade. Creating more tax revenue for the government.

- Used for small and medium business growth. Creating local jobs and follow on expansion of local trade. Creating more tax revenue for the government.

- Used for agriculture development.

Clearly new money can be directed towards money making schemes and is favoured by private banks. National banks with appropriate charters should tend to favour nation and job building. This they tend to do with low cost loans to business and farmers. In fact 0% government loans will work in this area as increased local production brings in more tax and decreases welfare. This is the concept of national public banks found in flourishing countries past and present. The government creates new money from treasury that is taxed out of existence a year later. In fact, with the government creating the new money and the government taxing the money, no national debt is possible. Debt only occurs to banks. Private banks at that. With private banks a very strange process occurs. The private banks create money out of thin air. Then the government gets into debt because it no longer has the ability to create the money needed operate and tax. The government gets into debt plus interest for the money that the bank created out of thin air. Then the taxes are increased to cover the interest on virtual money. And we all finish up working round the clock to pay debts and interest on money created out of thin air by banks that should never have been allowed to create the money in the first place. The nation then borrows more virtual money from international banks that also create invisible money. It must be virtual as nearly all countries owe money to the IMF and World bank. where did the IMF and World Bank get the money to lend to the countries? The countries export like crazy to pay their debts and we degrade the environment.

All that is needed for most countries to be stimulated and get out of debt is for the government to regain control of the money creation and spend into society. There are many examples of this.

The IMF gets it completely wrong with its austerity demands as it destroys the ability of the nation to rid itself of debt.

Although the IMF is even wrong before it even makes a loan with these destructive conditions. Instead of giving so called bailout loans, which are just massive increases in debt, a quality organisation would show a government how to regain control of the money creation and rid itself of debt encouraged by private corporate banks. Bailout loans are foreign loans that have to be paid to an overseas bank requiring massive export of natural resources or selling of national assets. In giving a bailout they are basically saying we now own your natural resources and public institutions. They are not bailouts they are essentially takeovers by foreign corporations at the time of creating the loan.

Warning: Never accept a loan from the IMF. Corporations will walk in and take over whatever they want.

Warning: If you defy the international banks there will be dire consequences. Much like defaulting on a car loan, a "secret organisation" called a "Think Tank" or "Foundation" or "Institute" run and funded by bankers and rich guys, will manufacture a reason for a war against your country which will be broadcast as "International News". The gullible public always believes the international new stories. Your nation will be flattened economically or literally. You will be accused of killing people, eating dead bodies, sexual perversion or whatever and assassinated in one form or another.

| |  | |  |

|  |

| |  | | |

"CHANGING BANKING FOR GOOD"

[In June 2013, the UK’s Parliamentary Commission on Banking Standards published a major investigation into the Banking system called "Changing Banking for Good".]

| |  | |

THE CHRISTIAN COUNCIL FOR MONETARY JUSTICE

[V4 P956] The Christian Council for Monetary Justice.... has advocated, for the UK, ending usury—and fractional reserve banking—by getting the Bank of England to take away from commercial banks the creation of most of the money in use.

This can be achieved in a single step when government instructs The Bank to issue, free of interest, all the money needed for the real economy as repayable debt. Any willing existing agency, such as high street banks, mortgage lenders, or credit unions, could administer the distribution of this interest-free credit for an administrative fee. This single step could be expected to crowd out undesirable features of the current system and to hugely benefit people engaged in healthy economic activity." | |  | |  |

| |  | |

PAUL MOORE

[V5 P1595 14.2] Over time, I have come to the very firm conclusion that ring-fencing, more capital, stronger corporate governance and regulation simply will not do the trick and that, to solve the huge economic problems we face, the entire monetary system and banking needs fundamental reform by the introduction of a system of “Full Reserve Banking” as proposed by Positive Money. | |  | |  |

| |  | |

PAUL MOORE

[V5 P1595 14.3] "The whole idea that 97% of our money supply is created, and its use in the economy is directed, by private commercial banks when they make loans is wrong. It bases pretty much everything we do economically on debt which banks are incentivised to oversell to make interest for themselves. It directly causes a constant transfer of wealth (through interest—about £160 billion per annum) from society as a whole (and particularly the poor) to the banks and so is a direct cause of the inequalities and associated social problems discussed in the great book called The Spirit Level. It means that asset bubbles (property) and boom and busts are inevitable and, most importantly, it cedes far too much power over our economy, our society and our lives directly to the banks and a tiny group of executive directors who are incentivised (and required by Company Law) to generate short-term profit. Of course, only around 10% or so of bank lending is made to the productive economy ie the SMEs with the vast majority going to residential and commercial mortgages and financial intermediation. Indeed, SME’s deposit more with banks than they ever borrow. Finally, the big 4 banks control well over 80% of the money supply which means that something like 25 executive directors, with no public duties whatsoever, to a very large extent control our monetary system and economy."  | |  | |  |

| |  | |

PAUL MOORE

[V5 P1595 14.4] Even Mervyn King has commented that this way of organising our monetary system and banking is not the best way to do it. Martin Wolf summed it up perfectly when he said—“The essence of the contemporary monetary system is the creation of money out of nothing, by private banks’ often foolish lending.”  | |  | |  |

| |  | |

PAUL MOORE

[V5 P1595 14.5] Positive Money  which was set up and is run by a remarkable young guy called Ben Dyson makes the case for reform of the monetary system through the introduction of Full Reserve Banking very powerfully indeed in their new book “Modernising Money”. You can check out what they say on their website here http://www.positivemoney.org which was set up and is run by a remarkable young guy called Ben Dyson makes the case for reform of the monetary system through the introduction of Full Reserve Banking very powerfully indeed in their new book “Modernising Money”. You can check out what they say on their website here http://www.positivemoney.org  . I am on the Advisory Committee of Positive Money. . I am on the Advisory Committee of Positive Money. | |  | |  |

| |  | |

PAUL MOORE

[V5 P1595 14.6] Policymakers need to look very carefully at introducing “Full Reserve Banking” (see Positive Money about all this) as this will completely remove the need for the State ever to stand behind banks again. The ICB simply ignored the idea of full reserve banking and its recommendations do not achieve this. It is wrong that the taxpayer has to provide a guarantee of £85,000 to each account holder in each bank. Full reserve banking is the best way to resolve this problem and the best way to ensure that banking is carried out in the interests of customers and society as a whole. It means that there can never be a run on current accounts and customers choose savings accounts with the level of lending risk with which they are comfortable just like collective investment schemes and the saver/investor bears the risk. | |  | |  |

| |  | |  |

|  |

| |  | | |

QUOTES ON MONEY CREATION

| |  | | Bank of England 2007

But by far the largest role in creating broad money is played by the banking sector. Banks intermediate funds by taking deposits and lending part of that money to others. When banks make loans they create additional deposits for those that have borrowed the money. There is, therefore, a strong link between the growth of money and credit. | |  | |  |

| |  | | Bank of England 2008

Given the near identity of deposits and bank lending, Money and Credit are often used almost inseparably, even interchangeably... | |  | |  |

| |  | | Graham Towers 1939

Each and every time a bank makes a loan, new bank credit is created—new deposits—brand new money.

Graham Towers, former Governor of the Bank of Canada | |  | |  |

| |  | | European Central Bank 2000

Over time... Banknotes and commercial bank money became fully interchangeable payment media that customers could use according to their needs. | |  | |  |

| |  | | Robert Hemphill

"This is a staggering thought. We are completely dependent on the Commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the banks create ample synthetic money, we are prosperous; if not, we starve. We are,absolutely, without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is."

[Robert H. Hemphill, Credit Manager, Federal Reserve Bank, Atlanta,Georgia. Perpetual Debt] | |  | |  |

| |  | | Bundesbank 2009

The actual process of money creation takes place primarily in banks. Federal Reserve Bank of Chicago (1961)

In the Eurosystem, money is primarily created through the extension of bank credit... The commercial banks can create money themselves. | |  | |  |

| |  | | IMF 2012

Banks do not have to wait for depositors to appear and make funds available before they can onlend, or intermediate, those funds. Rather, they create their own funds, deposits, in the act of lending. This fact can be verified in the description of the money creation system in many central bank tatements, and it is obvious to anybody who has ever lent money and created the resulting book entries. | |  | |  |

| |  | | Ellen Brown ”Web of Debt”

“Our money system is not what we have been led to believe. The creation of money has been "privatised," or taken over by private money lenders. Thomas Jefferson called them “bold and bankrupt adventurers just pretending to have money.” Except for coins, all of our money is now created as loans advanced by private banking institutions, including the privately-owned Federal Reserve. Banks create the principal but not the interest to service their loans. To find the interest, new loans must continually be taken out, expanding the money supply, inflating prices and robbing you of the value of your money. Not only is virtually the entire money supply created privately by banks, but a mere handful of very big banks is responsible for a massive investment scheme known as "derivatives," which now tallies in at hundreds of trillions of dollars. The banking system has been contrived so that these big banks always get bailed out by the taxpayers from their risky ventures, but the scheme has reached its mathematical limits. There isn’t enough money in the entire global economy to bail out the banks from a massive derivatives default today.” | |  | |  |

| |  | | John Kenneth Galbraith

"The process by which banks create money is so simple that the mind is repelled." | |  | |  |

| |  | | Mervyn King 2012

When banks extend loans to their customers, they create money by crediting their customers’ accounts. | |  | |  |

| |  | | William Lyon Mackenzie King

“Once a nation parts with the control of its currency and credit, it matters not who makes the nations laws. Usury, once in control, will wreck any nation. Until the control of the issue of currency and credit is restored to government and recognized as its most sacred responsibility, all talk of the sovereignty of parliament and of democracy is idle and futile.” | |  | |  |

| |  | | Henry Kissenger

"Who controls money controls the world." | |  | |  |

| |  | | H. L. Birum Senior 1957

"The Federal Reserve Bank is nothing but a banking fraud and an unlawful crime against civilization. Why? Because they "create" the money made out of nothing, and our Uncle Sap Government issues their "Federal Reserve Notes" and stamps our Government approval with no obligation whatever from these Federal Reserve Banks, Individual Banks or National Banks, etc." | |  | |  |

| |  | | Major Lawrence Lee Bazley Angus

“The modern banking system manufactures money out of nothing. The process is, perhaps, the most astounding piece of sleight of hand that was ever invented. Banks can in fact inflate, mint and un-mint the modern ledger-entry currency.” | |  | |  |

| |  | | G. D. McDaniel

"If, as it appears, the experiment that was called 'America' is at an end... then perhaps a fitting epitaph would be ... 'here lies America the greatest nation that might have been had it not been for the Edomite bankers who first stole their money, used their stolen money to buy their politicians and press and lastly deprived them of their constitutional freedom by the most evil device yet created --- The Federal Reserve Banking System.'" | |  | |  |

| |  | | Congressman Wright Patman

"In the United States today we have in effect two governments. We have the duly constituted government..... Then we have an independent, uncontrolled and uncoordinated government in the Federal Reserve System, operating the money powers which are reserved to Congress by the Constitution." | |  | |  |

| |  | | President James Garfield

"Whoever controls the volume of money in any country is absolute master of all industry and commerce."

| |  | |  |

| |  | | Nicolas Copernicus 1525

"Nations are not ruined by one act of violence, but quite often, gradually, and almost imperceptibly, by the depreciation of their currency, through excessive quantity".

| |  | |  |

| |  | | H.W. White 1955

“The banks do create money. They have been doing it for a long time, but they didn’t quite realise it, and they did not admit it. Very few did. You will find it in all sorts of documents, financial textbooks, etc. But in the intervening years, and we must all be perfectly frank about these things, there has been a development of thought, until today I doubt very much whether you would get many prominent bankers to attempt to deny that banks create credit.”

[H. W. White, Chairman of the Associated Banks of New Zealand, to the New Zealand Monetary Commission, 1955]

| |  | |  |

| |  | | Australian Reginald Williams

"Oh, alright. Rewrite the Banking Act to give the federal Treasurer power to control the nation’s money; reform the monetary system; limit the International Monetary Fund’s powers; resurrect the rural credits department; make foreign companies pay tax in Australia; allow gold producers to sell overseas and give people back control over their own money."

[Legendary Australian, R.M. Williams, when asked what message he would like to deliver to modern Australia said on his 90th birthday]

| |  | |  |

| |  | | Eustace Mullins

"As soon as Mr. Roosevelt took office, the Federal Reserve began to buy government securities

at the rate of ten million dollars a week for 10 weeks, and created one hundred million dollars in new [checkbook] currency, which alleviated the critical famine of money and credit, and the factories

started hiring people again."

| |  | |  |

| |  | |  |

|  |

| |  | | |

Paul Grignon

[Paul Grignon’s "Money As Debt" Documentary transcript]

| |  | | Those metal and paper symbols of value we usually think of as money are indeed produced by an agency of the federal government called the Mint. But the vast majority of money is not created by the Mint. It is created in huge amounts everyday by private corporations known as banks. Most of us believe that banks lend out money that has been entrusted to them by depositors. Easy to picture, but not the truth. In fact, banks create the loan, not from the banks own earnings, not from the money deposited, but directly from the borrower’s promise to repay. The borrower’s signature on the loan papers is an obligation to pay the bank the amount of the loan plus interest, or lose the house, the car,or whatever asset was pledged as collateral. That’s a big commitment from the borrower. What does the same signature require of the bank? The bank gets to conjure into existence the amount of the loan and just write it into the borrower’s account. Sound far-fetched?Surely, that can’t be true! But it is. | |  | |  |

| |  | | Despite the endlessly presented mint footage, government created money typically accounts for less than five percent of the money in circulation. More than 95% of all the money in existence today was created by someone signing a pledge of indebtedness to a bank.What’s more, this bank credit money is being created and destroyed in huge amounts everyday. New loans are made and old ones are repaid. | |  | |  |

| |  | | Banks can only practice this money system with the active participation of government. First, governments pass legal tender laws to make us use the national fiat currency. Secondly, governments allow private bank credit to be paid out as government currency. Thirdly,government courts enforce debts. And lastly, governments pass regulations to protect the money system’s functionality and credibility with the public while doing nothing to inform the public about where money really comes from. The simple truth is that when we sign on the dotted line for a so-called loan or mortgage our sign pledge of payment backed by the assets we pledge to forfeit should we fail to pay is the only thing of real value involved in the transaction. To anyone who believes we will honour our pledge that loan agreement or mortgage is now a portable, exchangeable, and saleable piece of paper. It’s an IOU. It represents value and is therefore a form of money. This money the borrower exchanges for the bank’s so-called loan. Now, a loan in the real world means that the lender must have something to lend. If you need a hammer my loaning you a promise to provide a hammer I don’t have won’t be of much help. But in the artificial world of money, a bank’s promise to pay money it doesn’t have is allowed to be passed off as money. And we accept it as such. | |  | |  |

| |  | | Once we realize that money really is debt we realize that if there is no debt there is no money. | |  | |  |

| |  | | No loans mean no money, which is what happened during the great depression. The money supply shrank drastically, as there was a 27% reduction in the supply of loans from 1929-33. | |  | |  |

| |  | | That’s not all, banks create only the amount of the principal. They don’t create the money to pay the interest. Where is that suppose to come from? The only place that borrowers can go to obtain the money to pay the interest is the general economy’s overall money supply

But almost all that overall money supply has been created exactly the same way as bank credit that has to be paid back with more than what was created. So everywhere there are other borrowers in the same situation. Frantically trying to obtain the money they need to pay back both principal and interest from a total money pool which contains only principal. It is clearly impossible for everyone to pay back the principal plus interest because the interest money doesn’t exist.The big problem here is that for long term loans such as mortgages and government debt the total interest far exceeds the principal. So unless a lot of extra money is created to pay the interest it means a very high proportion of foreclosure and a non functioning economy. To maintain a functioning society the rate of foreclosure needs to be low and so to accomplish this more and more new debt money has to be created to satisfy today’s demand for money to service the previous debt. But of course this just makes the total debt bigger and that means more interest must be repaid resulting in an ever escalating and inescapable spiral of mounting indebtedness. It is only the time lag between money’s creation as new loans and its repayment that keeps the overall shortage of money from catching up and bankrupting the entire system. However, as the banks insatiable credit monster gets bigger and bigger the need to create more and more debt money to feed it becomes increasingly urgent. Why are interest rates so low? Why do we get unsolicited credit cards in the mail? Why is the U.S. government spending faster than ever? Could it be to stave off collapse of the entire monetary system? A rational person has to ask can this really go on forever. Isn’t a collapse inevitable? | |  | |  |

| |  | | The problem of course is that perpetual growth of the real economy requires perpetually escalating new use of real world resources and energy. More and more stuff has to go from natural resource to garbage every year, forever, just to keep the system from collapsing. | |  | |  |

| |  | | What can we do about this downright scary situation? For one thing we need a very different concept of money. Its time more people ask themselves and their governments four simple questions. Around the world governments borrow money at interest from private banks. Government debt is a major component of the total debt and servicing that debt takes a big chunk of our taxes. Now we know that banks simply create the money they lend and the government has given them permission to do this. So the first question is: Why do governments choose to borrow money from private banks at interest when government could create all the interest free money it needs itself? And the second big question is: why create money as debt at all? Why not create money that circulates permanently and doesn’t have to be perpetually re-borrowed at interest in order to exist. The third question: how can a money system dependent on perpetually accelerating growth be used to build a sustainable economy? Isn’t it logical that perpetually accelerating growth and sustainability are incompatible? And finally: what is it about our current system that makes it totally dependent on perpetual growth? What specifically needs to change to allow the creation of a sustainable economy? | |  | |  |

| |  | | Usury

At one time charging any interest on a loan was called usury. It was subject to severe penalties including death. Every major religion forbade usury. Most of the arguments made against the practice were moral. It was held that money’s only legitimate purpose was to facilitate the exchange of goods and services. Any form of making money simply by having money was regarded as the act of a parasite or of a thief. However, as the credit means of commerce increased the moral arguments eventually gave way to the arguments that lending involves risk and loss of opportunity to the lender and therefore attempting to make a profit from lending is justified.Today these notions seem quaint. Today the notion of making money from money is held as an ideal to strive for (i.e. loans,mortgages, bonds, stock market trading, currency speculation, real estate flipping, etc). Why work when you can get your money to work for you? However, in trying to envision a sustainable future it is very clear that the charging of interest is both a moral and a practical problem. Imagine a society and an economy that can endure for centuries because instead of plundering its capital stores of energy it restricts itself to present day income. No more wood is harvested than grows in the same period. All energy is renewable (i.e. solar, wind,tidal, hyrdo, biomass, geothermal, etc). This society lives within the limits of its non renewable resources by reusing and recycling everything and the population just replaces itself. Such a society could never function using a money system utterly dependent on perpetually accelerating growth. A stable economy would need a money supply at least capable of remaining stable without collapsing. Let’s say we fix the total volume of this stable money supply to a given amount. Let’s also imagine that money lenders must actually have existing money to lend (i.e. no creating money as debt). If some people within this money supply begin systematically lending money supply at interest their share of the money supply willgrow. If they continually re-loan at interest all the money that get’s paid back, what’s the inevitable result? Whether it’s gold, fiat, or debt money it doesn’t matter. The money lenders will end up with all the money. And after the foreclosures and bankruptcies are all filed they will get all the real property too. Only if the proceeds of lending at interest were evenly distributed amongst the population would this central problem be solved. Heavy taxation of bank profits might accomplish this goal. But then why would banks want to be in business. If we are ever able to free ourselves of the current situation we could imagine banking run as a non-profit service to society dispersing its interest earnings as a universal citizen dividend for lending without charging interest at all. | |  | |  |

| |  | | Few people are aware today the history of the United States since the Revolution in 1776 has been in large part the story of an epic struggle (i.e. depressions, inflations, bank panics, war, infiltration, media ownership, mass deception, assassination, "education") to getfree and stay free of control by the European international banks. This struggle was finally lost in 1913 when President Woodrow Wilson signed into effect the Federal Reserve Act putting the international banking cartel in charge of creating America’s money. | |  | |  |

| |  | | The modern money as debt system was born a little over three hundred years ago when the first Bank of England was set up in 1694 with a Royal Charter for fractional lending of gold receipts at a modest ratio of two to one. That modest ratio was just the proverbial foot in the door. The system is now world wide and creates virtually unlimited amounts of money out of thin air and has almost everyone on the planet chained to a perpetually growing debt that can never be paid off. Could it have all happened by accident? Or is it a conspiracy?Obviously something very big is at stake here. | |  | |  |

| |  | |  |

|  |

| |  | | |

Michael Kumhof

| |  | |

“Virtually all money is bank deposits.

The key function of banks is money creation not intermediation. The entire economics literature that you see out there today is that it is intermediation, taking the money from granny, storing it up and then when someone comes and needs it I can lend it out to them. That is complete nonsense. Intermediation of course exists, but it is incidental and secondary and it comes after the actual money creation. Banks do not have to attract deposits before they create money. I’m a former bank manager. I worked for Barclays for five years. I’ve created those book entries. That is how it works. And if a leading light economist like Paul Krugman tries to tell you otherwise, he does not know what he is talking about.

When you approve a loan, as a bank manager you enter on the asset side of your balance sheet the loan, which is your claim against this guy and at the exact same time you create a new deposit on the liability side. You have created new money because this gives this guy purchasing power to go out and buy something with it. Banks have created money at that point. No intermediation, because the asset and liability are in the same name at that moment. What happens afterwards is that that guy can spend it somewhere else later but it is still in the banking system. I care about the aggregate banking system. Looking at the microeconomy and transferring the logic to the macroeconomy is really wrong. Someone will accept that payment.

What that means is that it becomes very, very easy for banks to start or lead a lending boom even though policy makers might not, because if they feel that the time is right, they simply expand the money supply. There is no third party involved, just the bank and the customer and I make the loan. The only thing that is required is that someone else will accept that deposit, say as payment for a machine, and he knows that is acceptable because it is legal fiat.

There is an important corollary to this story. A lot of loans are not for investment purposes, in physical capital. Loans that are for investment purposes are a small fraction. The story that is often told in development economics is that first you need to have savings, then once you have the savings, you can have investment. So a country needs to have sufficient savings in order to have enough investment. Nonsense too — at least for the part of investment that is financed through banks because when a bank makes a new loan it creates new purchasing power for the investment to go ahead. The investment goes ahead. Then the investor takes his new bank deposit and gives it to someone else In the end someone is going to leave that new deposit in the bank. That is saving. The saving is created along with the investment. It’s not that saving has to come before investment. Saving comes after investment, not before. This is important for development economics.

The deposit multiplier that is taught in economics textbooks is a fairytale. I could use less polite terms. The story goes that central bank creates narrow money and there is a multiplier because banks can lend out a fraction. It is actually exactly the opposite. Broad monetary aggregates lead the cycle and narrow monetary aggregates lag the cycle.”

Michael Kumhof. Transcript of the first seven minutes of a talk Michael Kumhof, economist from the IMF made to a seminar in January 2013. It is on youtube here and here is my transcript, give or take the odd aside I left out. By 'Deirdre'

| |  | |  |

| |  | |  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

Edward Bernays � 'Propaganda' 1928

"The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society."

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About