| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

To privately owned international banks that create the money out of thin air.

To privately owned international banks that create the money out of thin air.

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Sovereign debt to government income. Notice how they are all in debt!

greshams-law.com greshams-law.com

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

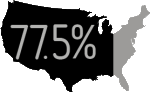

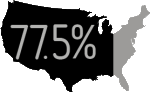

of American households are in debt.

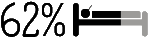

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

IMF:

An organization that claims to to promote international economic cooperation, international trade, employment, and exchange rate stability.

World Bank::

An international financial institution stating poverty reduction through foreign investment, international trade and facilitating capital investment, as it’s goal.

The IMF and World Bank are organization and financial institutions that were created under the disguise of helping the poor nations. In reality, these entities are cause crisis, failure and suffering. They strip away national assets and destroy economies in the name of privatization and liberalization.

| |  | |

By forcing governments to open up their economies to Western corporate capital under the name of ’free trade’, forcing their governments to sell off their people’s natural resources and state companies in the name of ’privatisation’, and to stop enforcing environmental, labor and other regulations under the name of ’deregulation’, the IMF and World Bank have created havoc and killed probably millions of people.

[YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz] [YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz]

They always demand a reduction in healthcare and education spending, but never demand that government projects are finished, or even monitored at all, which is why there is a huge proliferation of boondoggles and no development to show for ’donor aid’. In reality, they pay off local elites with ’donor aid’, in exchange for strict adherence to IMF/WB policies, to sell out the interests of the ordinary people in these countries.

[YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz] [YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz]

Nor do they demand that their governments are lean, so that many countries in Africa which comply, are still running 30 or more ministries - governments that are completely centralized, with no subsidiarity and devolution of power to local government, away from the ministries and the capital.

[YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz] [YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz]

In Zambia, the IMF demanded that the government sell the mines, and sign on to ’development agreements’ in which the foreign mine companies did not pay taxes, or shared profits (if they would ever honestly state their incomes to begin with - which they never do), which is why the government missed out on the huge boom in copper prices, costing the 1.7 billion per year government budget (1.1 billion from income taxes and 0.6 billion from ’donor aid’) over $10 billion in untaxed profits since 2004.

[YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz] [YouTube - (BBC) Greg Palast interviews former World Bank Economist Joseph Stiglitz]

| |  | |  |

| |  | |  |

|  |

| |  | | |

IMF'S FOUR STEPS TO DAMNATION

by Joseph Stiglitz

| |  | |

Also called 'Country Assistance Strategy.' An 'assistance' program is designed for each poor nation. The Bank hands each finance minister the same four-step programme. The finance minister is handed a 'restructuring agreement' pre-drafted for 'voluntary' signature.

Step One: Privatisation. (Briberization) Many politicians happily sell their electricity and water companies, influenced by the possibility of receiving heavy commissions for assistance with the sale. Carefully selected individuals are promoted with the media campaigns and money to change public opinion. The same faces keep on rotating, with no alternate choices for public to chose their Representatives. This happened in with the biggest privatisation of all, the 1995 Russian sell-off. The US-backed oligarchs stripped Russia’s industrial assets. This cut national output by nearly half. Depression and starvation followed.

Step Two: Capital market liberalisation. The capital market deregulation supposedly allows investment capital to flow in and out. However money tends to flow out. Cash comes in for speculation in real estate and currency, then flees at the first whiff of trouble. The nation's reserves may drain in days. Then the IMF demands these nations raise interest rates to 30%, 50% and 80%. Higher interest rates demolish property values, destroy industrial production and drain the national treasury.

Step Three: Market-based pricing. A fancy term for raising prices on food, water and cooking gas. This leads to

Step-Three-and-a-Half: The IMF riot'. The IMF riot is painfully predictable. When a nation is, 'down and out, [the IMF] squeezes the last drop of blood out of them. They turn up the heat until the whole cauldron blows up,' - as when the IMF eliminated food and fuel subsidies for the poor in Indonesia in 1998. Indonesia exploded into riots. There are other examples — the Bolivian riots over water prices and the riots in Ecuador over the rise in cooking gas prices imposed by the World Bank. These riots were totally expected.

According to several documents obtained from inside the World Bank, based on Interim Country Assistance Strategy for Ecuador, the Bank several times suggests that the plans could be expected to spark ‘social unrest’. That’s not surprising. The secret report notes that the plan to make the US dollar Ecuador’s currency has pushed 51% of the population below the poverty line.

The IMF riots (means peaceful demonstrations dispersed by bullets, tanks and tear gas) cause new flights of capital and government bankruptcies The remaining assets are then sold at fire sale prices. The clear winners seem to be the western banks.

Step Four: Free trade. This is free trade by the rules of the World Trade Organisation and the World Bank opening markets. Europeans and Americans today are kicking down barriers to sales in Asia, Latin American and Africa while barricading our own markets against the Third World's agriculture. ". . . because the plans are devised in secrecy and driven by an absolutist ideology, never open for discourse or dissent, they 'undermine democracy'. Second, they don't work. Under the guiding hand of IMF structural 'assistance' Africa's income dropped by 23%.

Botswana avoided this by telling the IMF to go packing.

[Joseph Stiglitz was an insider, a whistle blower who was fired from World Bank in 1999.]

joseph stiglitz imf four steps to damnation joseph stiglitz imf four steps to damnation

| |  | |  |

| |  | |  |

|  |

| |  | | |

QUOTES

| |  | |

IMF MEDICINE

The IMF has changed from serving the global economic interest to serving the interests of global finance.

The IMF has prescribed the same medicine for troubled third world economies for over two decades:

- Monetary austerity. Tighten up the money supply to increase internal interest rates to whatever heights needed to stabilise the value of the local currency.

- Fiscal austerity. Increase tax collections and reduce government spending dramatically.

- Privatisation. Sell off public enterprises to the private sector.

- Financial Liberalisation. Remove restrictions on the inflow and outflow of international capital as well as restrictions on what foreign businesses and banks are allowed to buy, own, and operate.

Only when governments sign this “structural adjustment agreement” does the IMF agree to:

- Lend enough itself to prevent default on international loans that are about to come due and otherwise would be un-payable.

- Arrange a restructuring of the country’s debt among private international lenders that includes a pledge of new loans.

[Robin Hanhel, Panic Rules!, (South End Press, 1999) P52]

| |  | |  |

| |  | |

A Spiraling Race to the Bottom by Anup Shah

As detailed further below, the IMF and World Bank provide financial assistance to countries seeking it, but apply a neoliberal economic ideology or agenda as a precondition to receiving the money. For example:

- They prescribe cutbacks, “liberalization” of the economy and resource extraction/export-oriented open markets as part of their structural adjustment.

- The role of the state is minimized.

- Privatization is encouraged as well as reduced protection of domestic industries.

- Other adjustment policies also include currency devaluation, increased interest rates, “flexibility” of the labor market, and the elimination of subsidies such as food subsidies.

- To be attractive to foreign investors various regulations and standards are reduced or removed.

The impact of these preconditions on poorer countries can be devastating. Factors such as the following lead to further misery for the developing nations and keep them dependent on developed nations:

- Poor countries must export more in order to raise enough money to pay off their debts in a timely manner.

Because there are so many nations being asked or forced into the global market place—before they are economically and socially stable and ready—and told to concentrate on similar cash crops and commodities as others, the situation resembles a large-scale price war.

- Then, the resources from the poorer regions become even cheaper, which favors consumers in the West.

- Governments then need to increase exports just to keep their currencies stable (which may not be sustainable, either) and earn foreign exchange with which to help pay off debts.

- Governments therefore must:

spend less

reduce consumption

remove or decrease financial regulations

and so on.

- Over time then:

the value of labor decreases

capital flows become more volatile

a spiraling race to the bottom then begins, which generates

social unrest, which in turn leads to "IMF riots" and protests around the world

- These nations are then told to peg their currencies to the dollar. But keeping the exchange rate stable is costly due to measures such as increased interest rates.

Investors obviously concerned about their assets and interests can then pull out very easily if things get tough

In the worst cases, capital flight can lead to economic collapse, such as we saw in the Asian/global financial crises of 1997/98/99, or in Mexico, Brazil, and many other places. During and after a crisis, the mainstream media and free trade economists lay the blame on emerging markets and their governments’ restrictive or inefficient policies, crony capitalism, etc., which is a cruel irony.

- When IMF donors keep the exchange rates in their favor, it often means that the poor nations remain poor, or get even poorer. Even the 1997/98/99 global financial crisis can be partly blamed on structural adjustment and early, overly aggressive deregulation for emerging economies.

- Millions of children end up dying each year.

http://www.globalissues.org/article/3/structural-adjustment-a-major-cause-of-poverty

| |  | |  |

| |  | |

Jeffrey Sachs

I think the IMF helped to detonate the Indonesian crisis.

The runs started in Thailand after the IMF intervened in such a dramatic way. Then the IMF came to Indonesia.

| |  | |  |

| |  | |

Abu Bakar Bashir

The Muslim leaders swallow the advice of the Western powers and bodies like the IMF and World Bank, even when it is bad for their countries and they know this.

| |  | |  |

| |  | |

Noam Chomsky

“Take the IMF. The IMF is not the World Bank, but it’s closely related. The IMF’s former U.S. executive director Karin Lissakers accurately described the Fund as the credit community’s enforcer. The IMF is very anti-capitalist. For example, suppose I lend you money. And I know that you’re a risky borrower, so I insist on a high-interest rate. Now, suppose that you can’t pay me back. In a capitalist system, it’s my problem. I made a risky loan. I got a lot of profit from the interest. You defaulted. It’s my problem.

That’s now what the IMF is about. What the IMF is saying, to put it in personal terms, is that your friends and neighbors have to pay off the loan. They didn’t borrow the money, but they have to pay it back. And my friends and neighbors have to pay me to make sure that I don’t lose any money. That’s essentially what the IMF is.

If Argentina takes out an IMF loan with huge interest rates because it’s risky and then they default, the IMF comes along and says the workers and peasants and other people in Argentina have to pay for that. They may not have borrowed it, it may have been borrowed by a military dictatorship, but they have to pay it back. That’s what structural adjustment is. And the IMF will ensure that western taxpayers pay off the bank. It’s radically anti-capitalist, whether you like that or not. The whole system has no legitimacy. In fact the whole debt system in the world, which is crushing much of the world, most of it is fake debt.

If Suharto, one of the biggest debtors in the world, borrows money and ends up the richest man in Indonesia or maybe the world, why is it the responsibility of the farmers in Indonesia to pay it off? They didn’t borrow it; they didn’t get anything from it. They were repressed, but they have to pay it off. And the IMF makes sure that the lenders don’t lose money on their risky loan after making a lot of profit from it. Why should the system even exist?”

| |  | |  |

| |  | |

John Perkins 2011

The first economic hit man, guys like Kermit Roosevelt, who overthrew the democratically elected President of Iran actually worked for the CIA.

http://www.whale.to/c/john_perkins1.html

| |  | |  |

| |  | |

Anup Shah

Many developing nations are in debt and poverty partly due to the policies of international institutions such as the International Monetary Fund (IMF) and the World Bank.

Their programs have been heavily criticized for many years for resulting in poverty. In addition, for developing or third world countries, there has been an increased dependency on the richer nations. This is despite the IMF and World Bank’s claim that they will reduce poverty.

Following an ideology known as neoliberalism, and spearheaded by these and other institutions known as the “Washington Consensus” (for being based in Washington D.C.), Structural Adjustment Policies (SAPs) have been imposed to ensure debt repayment and economic restructuring. But the way it has happened has required poor countries to reduce spending on things like health, education and development, while debt repayment and other economic policies have been made the priority. In effect, the IMF and World Bank have demanded that poor nations lower the standard of living of their people.

http://www.globalissues.org/article/3/structural-adjustment-a-major-cause-of-poverty

| |  | |  |

| |  | |  |

|  |

| |  | | |

Linked Articles

Who is afraid of the IMF? Their opportunity and ours Who is afraid of the IMF? Their opportunity and ours

World Bank and IMF support of dictatorships World Bank and IMF support of dictatorships

| |  | |  |

|  |

| |  | |

Examples abound on the international playing field as well. BBC reporter Greg Palast’s revelations about the reasons for the resignation of World Bank executive Joe Stiglitz have exploded the myths about international privatization, describing the IMF and World Bank roles in forcing below market transfers to Enron, such as the water system of Buenos Aires and the pipeline that runs between Argentina and Chile.[10]

[Mapping the Real Deal: Where would Jesus Bank? by Catherine Austin Fitts 4 July 2004]

| |  | |  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

"Once a nation parts with the control of its currency and credit, it matters not who makes the nations laws. Usury, once in control, will wreck any nation. Until the control of the issue of currency and credit is restored to government and recognized as its most sacred responsibility, all talk of the sovereignty of parliament and of democracy is idle and futile."

William Lyon Mackenzie King

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About