| |  | | |

Hi to Nicky from Starbucks, Athens. Please click the button below and do not forget to send me an email! Many thanks. Andy.

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

|  |

| |  | | |

| |  | |

These are draft versions! Please send me any errors so I can complete the work. Thanks Andy.

| |  | |  |

| |  | |  |

|  |

| |  | | |

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

| |  | |  |

|  |

| |  | | |

Our current financial system has left us with the highest personal debt in history, unaffordable housing, worsening inequality, high unemployment and banks that are subsidised and underwritten with taxpayers’ money. Positive Money is a movement to democratise money and banking so that it works for society and not against it.

www.positivemoney.org www.positivemoney.org

| |  | |  |

|  |

| |  | | |

Jubilee Debt Campaign is part of a global movement demanding freedom from the slavery of unjust debts and a new financial system that puts people first. Inspired by the ancient concept of ‘jubilee’, we campaign for a world where debt is no longer used as a form of power by which the rich exploit the poor.

jubileedebt.org.uk jubileedebt.org.uk

| |  | |  |

|  |

| |  | | |

For millions of people around the world, prospects for a better future are buried under old debts. In the 1960s and 70s, developed nations and the international institutions loaned millions upon millions of dollars to countries that had no capability of paying them back. The loans were presented as a means to development and poverty alleviation. In reality, it was more like political commerce, trying to buy the alliance of commodity rich countries across the developing world. Creditors agreed to give money to administrations and dictators that were known to be corrupt and non-democratic. They funded projects that were of no benefit to the people, but which were profitable for the companies involved, and for the corrupt elites in the developing nations. Interest rates shot up in 1979 making interest payments unmanageable. The debtor nations took out new loans to make debt repayments. The living conditions of the most deprived people in the world have deteriorated almost everywhere over the last twenty years. Yet wealthy governments and international financial institutions never cease to demand the repayment of those debts.

jubileeaustralia.org jubileeaustralia.org

| |  | |  |

|  |

| |  | | |

Rolling Jubilee is a Strike Debt  project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning. project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal. Debt resistance is just the beginning.

US Tuition Debt is over $1 000 000 000 000.

rollingjubilee.org rollingjubilee.org

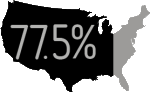

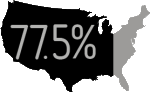

of American households are in debt.

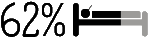

of all bankruptcies are caused by medical debt.

Student debt has exploded.

1 in every 7 Americans is being pursued by a debt collector.

of indebted households used credit cards to pay for basic living expenses.

| |  | |  |

|  |

| |  | | |

The Move Your Money campaign -- the ongoing effort to encourage mega-bank customers to move their money to local institutions has had great success. The Occupy movement’s outrage over Wall Street ran a Bank Transfer Day on 5 November. ~5.6 million customers moved their money.

| |  | |  |

|  |

| |  | | |

The Robin Hood Tax is a tiny tax (0.05%) on banks, hedge funds and other finance institutions. Levied on foreign exchange transactions, derivatives and share deals, it could raise hundreds of billions of dollars annually.

| |  | |  |

|  |

|

|

|

| |  | | |

Usury was defined as the lending of lending money with interest.

To permit usury it has been softened to:

Usury is now defined as the lending of lending money at an exorbitant interest.

| |  | |  |

|  |

| |  | | |

Why Islam Is Against Lending Money At Interest

Politicians have seldom looked at money-lending at interest as the cause of widespread poverty in the midst of plenty, because whilst this practice was once forbidden by Judaism, Christianity and Islam alike, it has become universally accepted in the modern world of secularism. It has been argued that money is a "producer good" and that the lender should receive a share of the extra wealth that these goods produce. Yet this is illogical on several points. The only true producer of wealth (i.e. goods and services) is Labour when it is applied to either Land or Capital. Unlike Land, Money is infinite when not artificially restricted, which it often is. Money is man-made out of nothing and at tiny real cost. This credit creation confers enormous economic power and influence on those usually private institutions who have secured for themselves monopoly rights in this money issue.

That private banks create money out of nothing is a fact too little known amongst the public. Our national debt stands at over 200 billion pounds, and that of other industrialised countries is of similar magnitude. Have you ever asked yourself who is that fabulous lender who always seems to have all the money which the government does not have? Whom does the nation owe the national debt? The truth is that when banks create money (as cheque-money or blips on computer screens) they lend what they have not got to reap where they did not sow. Their loans are not backed by any real wealth on their behalf. Nor do they lend out depositors’ money (or when did the bank last tell you that you can’t take out money from your account, because it has been lent to someone else?). When you give your house or business as guarantee for their money, this money is not backed by gold, silver or tangible wealth. It is an empty promise except for the fact that the govenment, with the central bank as lender of the last resort, is ready to bail out the banks should a run on their money occur. Bank-created credit is based on the nation’s capacity to produce and consume in the sense that whilst it is not issued nor backed by the government, the government - being the largest debtor - guarantees a certain return in debt service payments from its revenue. An increasing part of local and national government taxation today is raised for the purpose of servicing the interest payments on local and national govemment debt. So whether you personaily borrow or not, you pay the interest on that fictitious rnoney. Likewise, when you take a bank loan, you pay at least twice: you give a guarantee of real wealth in case of default, and you pay a penalty (as interest) for accepting money as a loan which costs the lender nothing and did not exist until it was created as a loan to you. Heads you lose, tails you lose again...

As should be evident by now, to base an economy on interest is a pretty stupid way of servicing a nation’s need to produce, consume and trade. It results in the evils of inflation, unemployment, decline of services, trading war, and finally, shooting-wars. Using interest rates as a means to control the problems of a nation’s economy is futile, as these problems were created by interest in the first place. Only when a government creates its own money supply free of charge to the nation to facilitate production, consumption and trade, instead of authorising private banks to create the nation’s money and then holding the nation at ransom by breaking its back under the ensuing interest debt, only when we get back to a system where the usurer is not being rewarded for taking advantage of others’ difficulties, will we achieve real prosperity.

Islam, often laughed at for sticking to its principles and not "moving with the times", has never given in to the demands of the money-lenders to change its tough stance on interest. Naturally, Islam has increasingly been attacked by the financial interests behind today’s media and politics. Looking at the evidence with an open mind, however, it should not take you long to realise that Islam makes sense, and interest doesn’t.

And Allah knows best!

The Facts About Usury: Why Islam Is Against Lending Money At Interest

| |  | |  |

|  |

| |  | | |

Quotes Islamon Usury

| |  | |

"The rich ruleth over the poor, and the borrower is servant to the lender" -- Proverbs 22:7

| |  | |  |

| |  | |

Benjamin Franklin

"Who goeth a borrowing goeth a sorrowing"

| |  | |  |

| |  | |

"Those who swallow down usury cannot arise except as one whom Satan has prostrated by his touch does rise. That is because they say, trading is only like usury; and Allah has allowed trading and forbidden usury. To whomsoever then the admonition has come from his Lord, then he desists, he shall have what is already passed, and his affairs is in the hands of Allah; and whoever returns to it -- these are the inmates of the fire; they shall abide in it. . ." -- From the Qur’an, Surah Al-Baqarah.

| |  | |  |

| |  | |  |

|  |

|

|

| |  | | |

Public Banking -- it already works in the United States and is catching on! Twenty States are considering some form of state banking legislation.

publicbankinginstitute.org publicbankinginstitute.org

| |  | |  |

|  |

|  |

| |  | | |

SUCKERS

You are in debt for virtual money that did not exist until the person that lent it to you, created it out of nothing. Then the same person charged interest on the virtual money that appeared out of nowhere. There is now more debt then money so someone will default on this non-existent virtual money. Lender now owns your house because you are stupid enough to believe that you owe him money that never existed before he lent you the money.

In fact you can actually create money your self. Its called the LETS scheme.

lets + scheme + money + creation lets + scheme + money + creation

But a better way is to stop the corportate banks creating debt money and create money direct form Treasury in the same way that treasury creates the Australian coins. Or create money from a government public bank.

public + bank public + bank

| |  | |  |

|  |

|  |

| |  | | |

MONEY SUPPLY AND DEBT

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.”

Ellen Brown in Web of Debt Ellen Brown in Web of Debt

| |  | |  |

|  |

| |  | | |

Alex Carey

"The 20th century has been characterized by four developments of great importance: the growth of political democracy, the growth of Online Democracy, the growth of corporate power, and the growth of corporate propaganda as a means of protecting corporate power against democracy.

| |  | |  |

|  |

| |  | | |

Today we face a crushing burden of foreclosures, dropping incomes, and a financial elite that has bought our government. The elite consensus is powerful enough to prevent change, no matter who is elected. The situation seems, at least in electoral terms, hopeless. Yet, America has been here before, and has shown remarkable resilience in the darkest of times.

So just how do we get the debate we deserve? How do we root out the corruption, greed, and fraud in our system? Clearly, the root of much evil in our system of government comes from the financing of political campaigns by powerful interests. And the Supreme Court has said that money is speech, and thus, protected by the Constitution. So we must pass a Constitutional amendment to speak back to the Supreme Court, and assert the primacy of government by the people.

getmoneyout.com getmoneyout.com

| |  | |  |

|  |

| |  | | |

Derivatives: The Unregulated Global Casino for Banks Derivatives: The Unregulated Global Casino for Banks

Who Loaned Greece the Money Who Loaned Greece the Money

Cyprus Financial Crisis: Deposit Confiscation Cyprus Financial Crisis: Deposit Confiscation

Illusion of Insured Bank Deposits Illusion of Insured Bank Deposits

Food Stamp Nation Food Stamp Nation

Presidential Elections Presidential Elections

World In Debt World In Debt

Cost of War Cost of War

European Debt European Debt

| |  | |  |

|  |

|

|

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

The money setup of Europe guarantees increasing debt to the Keynsian Endpoint. The point at which the Tax Department becomes a collection agency for the banks. The point at which debt repayment exceeds tax revenue.

About

About